UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

________________________________________________

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

| | | | | | | | |

Check the appropriate box: | | |

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-2 | |

SUNRUN INC.

(Name of Registrant as Specified In Its Charter)

| | | | | | | | |

Payment of Filing Fee (Check the appropriate box): | | |

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | | Title of each class of securities to which transaction applies: |

| | |

| (2) | | Aggregate number of securities to which transaction applies: |

| | |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | | Proposed maximum aggregate value of transaction: |

| | |

| (5) | | Total fee paid: |

| | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | | Amount Previously Paid: |

| | |

| (2) | | Form, Schedule or Registration Statement No.: |

| | |

| (3) | | Filing Party: |

| | |

| (4) | | Date Filed: |

| | |

| | |

Dear Fellow Stockholders:

We cordially invite you to attend the 2020 annual meeting of stockholders (the “Annual Meeting”) of Sunrun Inc., a Delaware corporation, which will be held on Tuesday, June 2, 2020 at 8:30 a.m. Pacific Time, in person at 225 Bush Street, Suite 1400, San Francisco, California 94104.

Please note that as part of our precautions regarding coronavirus or COVID-19, we are planning for the possibility that the annual meeting may be held by means of remote communication, such as a virtual annual meeting online. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be available at https://investors.sunrun.com/. We continue to monitor the situation closely and are taking into account applicable regulations and ordinances. The health and well-being of our employees, shareholders, and other community stakeholders remain our top priority.

At this year’s meeting, we will vote on the election of directors and the ratification of the selection of Ernst & Young LLP as Sunrun’s independent registered public accounting firm. We will also conduct a non-binding advisory vote to approve the compensation of Sunrun’s named executive officers. Finally, we will transact such other business as may properly come before the meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. You may vote over the Internet, by telephone or by mailing a completed proxy card or voting instruction form (if you request printed copies of the proxy materials to be mailed to you). Your vote by proxy will ensure your representation at the Annual Meeting regardless of whether you attend the meeting. Details regarding admission to the Annual Meeting and the business to be conducted are described in the accompanying Notice of 2020 Annual Meeting of Stockholders and Proxy Statement.

Our mission is to create a planet run by the sun, and your support is helping make that mission a reality. Thank you for your continued investment in Sunrun.

| | |

|

| Lynn Jurich |

| Chief Executive Officer & Co-Founder |

| San Francisco, California |

| April 17, 2020 |

225 Bush Street, Suite 1400

San Francisco, California 94104

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 8:30 a.m. Pacific Time on Tuesday, June 2, 2020

Dear Stockholders of Sunrun Inc.:

The Annual Meeting of Stockholders (the “Annual Meeting”) of Sunrun Inc., a Delaware corporation, which will be held on Tuesday, June 2, 2020 at 8:30 a.m. Pacific Time, in person at 225 Bush Street, Suite 1400, San Francisco, California 94104, for the following purposes, as more fully described in the accompanying proxy statement:

1. To elect the three nominees to serve as Class II directors until the 2023 annual meeting of stockholders and until their successors are duly elected and qualified;

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020;

3. To approve, on an advisory basis, the compensation of our named executive officers (“Say-on-Pay”), as disclosed in the proxy statement; and

4. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

As part of our precautions regarding COVID-19, we are planning for the possibility that the annual meeting may be held by means of remote communication, such as a virtual annual meeting online. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be available at https://investors.sunrun.com/.

Our board of directors has fixed the close of business on April 8, 2020 as the record date for the Annual Meeting. Only stockholders of record on April 8, 2020 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

On or about April 17, 2020, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement and our annual report. The Notice provides instructions on how to vote via the Internet or by telephone and includes instructions on how to receive a paper copy of our proxy materials by mail. The accompanying proxy statement and our annual report can be accessed directly at the following Internet address: www.voteproxy.com. All you have to do is enter the control number located on your Notice or proxy card.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail.

| | |

| By order of the Board of Directors, |

|

| Jeanna Steele |

| General Counsel & Corporate Secretary |

| San Francisco, California |

| April 17, 2020 |

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Policies and Procedures for Related Party Transactions | |

| | |

| | |

| | |

| | |

PROXY STATEMENT

FOR 2020 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 8:30 a.m. Pacific Time on Tuesday, June 2, 2020

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2020 annual meeting of stockholders of Sunrun Inc., a Delaware corporation, (“Sunrun” or the “Company”), and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held on Tuesday, June 2, 2020 at 8:30 a.m. Pacific Time, at 225 Bush Street, Suite 1400, San Francisco, CA 94104. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report is first being mailed or available to stockholders on or about April 17, 2020 to all stockholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

What matters am I voting on?

You will be voting on the following proposals:

•the election of three Class II directors as named in this proxy statement to serve until our 2023 annual meeting of stockholders;

•the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020;

•the advisory approval of the compensation of our named executive officers (“Say-on-Pay”), as disclosed in the proxy statement; and

•any other business as may properly come before the Annual Meeting.

As of the date of this proxy statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting.

How does the board of directors recommend I vote on these proposals?

Our board of directors recommends a vote:

•“FOR” the election of Leslie Dach, Edward Fenster and Mary Powell as Class II directors;

•“FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020; and

•“FOR” the advisory approval of the compensation of our named executive officers (“Say-on-Pay”), as disclosed in the proxy statement.

Who is entitled to vote?

Holders of our common stock as of the close of business on April 8, 2020, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting.

Registered Stockholders. If on April 8, 2020, shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or vote in person at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If on April 8, 2020, shares of our common stock are held on your behalf in a stock brokerage account, or by a bank, trustee or other nominee, you are considered the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares and are also invited

to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock in person at the Annual Meeting unless you follow your broker or nominee’s procedures for obtaining a legal proxy. Your broker or nominee is obligated to provide you with instructions to vote before the Annual Meeting or to obtain a legal proxy if you wish to vote in person at the Annual Meeting. If your broker or nominee is participating in an online program that allows you to vote over the Internet or by telephone, your Notice or other voting instruction form will include that information. If what you receive from your broker or other nominee does not contain Internet or telephone voting information, please complete and return the paper form in the self-addressed, postage paid envelope provided by your broker or nominee. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank, trustee or other nominee as “street name stockholders.”

What constitutes a quorum for the Annual Meeting?

A quorum is required for stockholders to conduct business at the Annual Meeting. The presence, in person or represented by proxy, of the holders of a majority of the outstanding shares of our common stock is necessary to establish a quorum at the meeting. As of the close of business on the record date, there were 120,134,635 shares of our common stock outstanding. Shares present, in person or represented by proxy, including shares as to which authority to vote on any proposal is withheld, shares abstaining as to any proposal and broker non-votes (where a broker submits a properly executed proxy but does not have authority to vote a stockholder’s shares) on any proposal will be considered present at the meeting for purposes of establishing a quorum.

How many votes do I have?

In deciding all matters at the Annual Meeting, each stockholder will be entitled to one vote for each share of our common stock held by them on the record date. Stockholders are not permitted to cumulate votes with respect to the election of directors.

How many votes are needed to approve each proposal?

•Proposal No. 1: The election of directors requires a plurality vote of the shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as directors. Any shares not voted “FOR” a particular nominee (as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “FOR” or “WITHHELD” on each of the nominees.

•Proposal No. 2: The ratification of the appointment of Ernst & Young LLP requires the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “AGAINST.” Broker non-votes will have no effect on the outcome of this proposal.

•Proposal No. 3: The approval, on an advisory basis, of the compensation of our named executive officers requires the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote. As described in Proposal No. 2 above, an abstention will have the same effect as a vote “AGAINST” and broker non-votes will have no effect.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

• By Internet: You may submit a proxy over the Internet by following the instructions at www.voteproxy.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time the day before the Annual Meeting (have your Notice or proxy card in hand when you visit the website);

• By Toll-free Telephone: You may submit a proxy by calling 1-800-776-9437 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time the day before the Annual Meeting (have your Notice or proxy card in hand when you call);

• By Mail: You may complete, sign and mail your proxy card (if you received printed proxy materials) which must be received by us no later than the day before the Annual Meeting; or

• In Person: You may vote in person by written ballot at the Annual Meeting.

Even if you plan to attend the Annual Meeting in person, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend.

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank trustee or other nominee in order to instruct your broker or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning an instruction card, by telephone

or by Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your broker, bank, trustee or other nominee.

Can I change my vote after submitting my proxy?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting in any one of the following ways:

• You may enter a new vote by Internet or by telephone until 11:59 p.m. Eastern Time the day before the Annual Meeting;

• You may submit another properly completed, proxy card by mail with a later date, which must be received by us no later than the day before the Annual Meeting;

• You may send written notice that you are revoking your proxy to our Secretary at Sunrun Inc., 225 Bush Street, Suite 1400, San Francisco, CA 94104, which must be received by us no later than the day before the Annual Meeting; or

• You may attend the Annual Meeting in person and complete a written ballot at the Annual Meeting.

If you are a street name stockholder, your broker or nominee can provide you with instructions on how to change your vote.

What do I need to do to attend the Annual Meeting in person?

Space for the Annual Meeting is limited. Therefore, admission will be on a first-come, first-served basis. Registration will open at 8:00 a.m. Pacific Time and the Annual Meeting will begin at 8:30 a.m. Pacific Time. If you attend the Annual Meeting, please be prepared to present:

• valid government photo identification, such as a driver’s license or passport; and

• if you are a street name stockholder, proof of beneficial ownership as of April 8, 2020, the record date, such as your most recent account statement reflecting your stock ownership on April 8, 2020, along with a copy of the voting instruction card provided by your broker, bank, trustee or other nominee or similar evidence of ownership.

Please allow ample time for check-in and parking if attending the Annual Meeting in person. Use of cameras, recording devices, computers and other electronic devices, such as smartphones and tablets, will not be permitted at the Annual Meeting.

Please note that as part of our precautions regarding COVID-19, we are planning for the possibility that the annual meeting may be held by means of remote communication, such as a virtual annual meeting online. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be available at https://investors.sunrun.com/.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Our board of directors has designated Lynn Jurich, Ed Fenster, Bob Komin and Jeanna Steele as proxy holders. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described under “How does the board of directors recommend I vote on these proposals?” above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned to a later date, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions before the new date, as described above.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 17, 2020 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact of our annual meetings of stockholders.

How are proxies solicited for the Annual Meeting and who will bear the cost of this solicitation?

Our board of directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

How may my brokerage firm or other nominee vote my shares if I fail to provide timely directions?

Brokerage firms and other nominees, for example banks or agents, holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on Proposal No. 2, our sole “routine” matter, but brokers and nominees cannot use their discretion to vote “uninstructed” shares with respect to matters that are considered “non-routine”. “Non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, election of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation) and certain corporate governance proposals, even if management supported. Accordingly, your broker or nominee may not vote your shares on Proposals Nos. 1 or 3 without your instructions, but may vote your shares on Proposal No. 2.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8‑K (“Form 8-K”) that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8‑K within four business days after the Annual Meeting, we will file a Form 8‑K to publish preliminary results and will provide the final results in an amendment to the Form 8‑K as soon as they become available.

What is the deadline for stockholders to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to our Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2021 annual meeting of stockholders, our Secretary must receive the written proposal at our principal executive offices not later than December 18, 2020. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

Sunrun Inc.

Attention: Secretary

225 Bush Street, Suite 1400

San Francisco, CA 94104

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with respect to such meeting, (ii) otherwise properly brought before such meeting by or at the direction of our board of directors, or (iii) properly brought before such meeting by a stockholder of record entitled to vote at the annual meeting who has delivered timely written notice to our Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for our 2021 annual meeting of stockholders, our Secretary must receive the written notice at our principal executive offices:

• not earlier than February 1, 2021; and

• not later than the close of business on March 3, 2021.

In the event that we hold our 2021 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement

must be received no earlier than the close of business on the 120th day before our 2021 annual meeting of stockholders and no later than the close of business on the later of the following two dates:

• the 90th day prior to our 2021 annual meeting of stockholders; or

• the 10th day following the day on which public announcement of the date of our 2021 annual meeting of stockholders is first made.

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.

Nomination of Director Candidates

You may propose director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directors and should be directed to our Secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Board of Directors and Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors.”

In addition, our amended and restated bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Secretary within the time periods described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Availability of Bylaws

A copy of our amended and restated bylaws is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Corporate Governance” section. You may also contact our Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our board of directors, which is currently composed of seven members. Five of our directors are independent within the meaning of the listing standards of The Nasdaq Stock Market (“Nasdaq”). Our board of directors is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring.

The following table sets forth the names, ages as of April 17, 2020, and certain other information for each of the directors with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting), and for each of the continuing members of our board of directors:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class | | Age | | Position | | Director

Since | | Current

Term

Expires | | Expiration

of Term

For Which

Nominated |

Directors with Terms Expiring at the Annual Meeting/Nominees | | | | | | | | | | | | |

Leslie Dach (1) (3) | | II | | 66 | | Director | | 2016 | | 2020 | | 2023 |

| Edward Fenster | | II | | 43 | | Executive Chairman and Director | | 2007 | | 2020 | | 2023 |

Mary Powell (2) (3) | | II | | 59 | | Director | | 2018 | | 2020 | | 2023 |

| | | | | | | | | | | | |

| Continuing Directors | | | | | | | | | | | | |

Katherine August-deWilde (1) (2) | | III | | 72 | | Director | | 2016 | | 2021 | | — | |

Gerald Risk (3) (4) | | III | | 51 | | Director | | 2014 | | 2021 | | — | |

| | | | | | | | | | | | |

Alan Ferber (1) (2) | | I | | 52 | | Director | | 2018 | | 2022 | | — | |

| Lynn Jurich | | I | | 40 | | Chief Executive Officer and Director | | 2007 | | 2022 | | — | |

______________________

(1) Member of our nominating and corporate governance committee

(2) Member of our compensation committee

(3) Member of our audit committee

(4) Lead Independent Director

Nominees for Director

Leslie Dach. Mr. Dach has served as a member of our board of directors since May 2016. Mr. Dach brings more than 25 years of experience running major business and strategic initiatives across the public, private and civil sectors, including leading corporate affairs and sustainability at Walmart Stores Inc. from 2006 to 2013. Mr. Dach served as senior counselor to the Secretary of the U.S. Department of Health & Human Services from 2014 to 2016. Prior to that, Mr. Dach served as executive vice president of corporate affairs for Walmart and was a member of the company’s executive council and executive finance committee. Mr. Dach has served on numerous boards including the Environmental Defense Fund, World Resources Institute, United Negro College Fund, the Yale University Council and the National Audubon Society. He previously served on our board of directors from June 2013 to July 2014. Mr. Dach holds a B.S. in Biology from Yale University and an M.P.A. from Harvard University.

Mr. Dach was selected to serve on our board of directors because of his extensive business experience in both the public and private sector and his prior experience with the Company.

Edward Fenster. Mr. Fenster is one of our co-founders and has served as our Executive Chairman since March 2014 and as a member of our board of directors since inception. Mr. Fenster served as our Chief Executive Officer from June 2008 to October 2012, and our Co-Chief Executive Officer from October 2012 to March 2014. From May 2003 to June 2005, Mr. Fenster served as Director of Corporate Development at Asurion, LLC, a technology device protection and support company. From July 1999 to May 2003, Mr. Fenster worked at The Blackstone Group, a private equity firm. Mr. Fenster holds a B.A. in Economics from Johns Hopkins University and an M.B.A. from the Stanford Graduate School of Business.

Mr. Fenster was selected to serve on our board of directors because of the perspective and experience he brings as one of our co-founders and as one of our largest stockholders.

Mary Powell. Ms. Powell served as the President and Chief Executive Officer of Green Mountain Power Corporation, an electric services company that serves 75% of the State of Vermont’s residential and business customers, from 2008 to 2019. Her previous roles at Green Mountain Power Corporation included Senior Vice President and Chief Operations Officer from 2001-2008, and Senior Vice President, Customer and Organizational Development from 1999-2001. Ms. Powell has been nationally recognized for her work transforming the energy system by outlets including Fast Company magazine and has received numerous industry awards, most recently being named Utility Dive’s 2019 “Executive of the Year” in recognition for her leadership of Vermont’s investor-owned utility to prioritize and deliver on customer-choice distributed energy solutions. Ms. Powell currently serves on the board of directors of Hawaiian Electric Industries Inc. (NYSE: HE), the largest utility in Hawaii. She also serves on the boards of a number of other privately held companies and nonprofits, including Rocky Mountain Institute, a world-renowned energy think tank, and Énergir, a privately held energy company in Quebec, Canada. Ms. Powell holds an Associate’s degree from Keene State College.

Ms. Powell was selected to serve on our board of directors because of her extensive experience and knowledge of the energy and utility industry.

Continuing Directors

Katherine August-deWilde. Ms. August-deWilde has served as a member of our board of directors since January 2016. Ms. August-deWilde is currently the Vice Chair of First Republic Bank (NYSE: FRC), a position she has held since the beginning of 2016, and has served on the board of directors since 1988. First Republic Bank offers private personal banking, private business banking, and private wealth management services. Ms. August-deWilde has held several executive leadership roles at the company, including COO from 1993 - 2014, and President from 2007 - 2015. Previously, Ms. August-deWilde was Senior Vice President and Chief Financial Officer at PMI Group. Ms. August-deWilde currently serves on the board of directors of Eventbrite Inc. (NYSE: EB), a self-service ticketing and registration company, and TriNet Group Inc. (NYSE: TNET), a human resource software solutions company for businesses, as well as a number of privately held companies. She holds a B.A. degree from Goucher College and an M.B.A. from Stanford Graduate School of Business.

Ms. August-deWilde was selected to serve on our board of directors because of her extensive experience in the consumer-facing financial industry.

Gerald Risk. Mr. Risk has served as a member of our board of directors since February 2014. Since March 2013, Mr. Risk has served as Vice Chairman at Asurion, LLC, a company that provides device detection and support services, and previously served as its President from May 2009 to March 2013 and its Chief Financial Officer from February 1999 to May 2009. Mr. Risk currently serves on the boards of directors of a number of privately held companies. Mr. Risk holds a Bachelor of Commerce from Queen’s University and an M.B.A. from the Stanford Graduate School of Business.

Mr. Risk was selected to serve on our board of directors because of his extensive executive experience and his experience as an operator and investor building emerging growth businesses.

Alan Ferber. Mr. Ferber has served as the Chief Executive Officer of Jackson Hewitt Tax Services, a provider of tax preparation services, since January 2017. Prior to joining Jackson Hewitt, Mr. Ferber was President of ADT Residential, a home security company, from 2013 until 2016. He also previously held the role of Senior Vice President and Chief Customer Officer for ADT. His other experience includes holding several executive leadership positions at US Cellular, a telecommunications company, from 2001 until 2012 including serving as Executive Vice President and Chief Operating Officer, Chief Strategy and Brand Officer. Mr. Ferber received a Bachelor of Arts degree in economics from the University of Michigan, and an M.B.A. with a concentration in finance and marketing from Northwestern University’s Kellogg Graduate School of Management.

Mr. Ferber was selected to serve on our board of directors because of his experience and knowledge of consumer-facing industries.

Lynn Jurich. Ms. Jurich is one of our co-founders and has served as our Chief Executive Officer since March 2014 and as a member of our board of directors since inception. Ms. Jurich served as our Co-Chief Executive Officer from October 2012 to March 2014, our President from January 2009 to October 2012, and our Executive Vice President of Sales and Marketing from 2007 to January 2009. From July 2002 to July 2005, Ms. Jurich served as an associate at Summit Partners, a private equity firm. Ms. Jurich serves on the board of directors of privately held Generate Capital, Inc. Ms. Jurich holds a B.S. in Science, Technology, and Society from Stanford University and an M.B.A. from the Stanford Graduate School of Business.

Ms. Jurich was selected to serve on our board of directors because of the perspective and experience she brings as one of our co-founders and as one of our largest stockholders.

Director Independence

Our common stock is listed on Nasdaq. Under the listing standards of Nasdaq, independent directors must comprise a majority of a listed company’s board of directors, as affirmatively determined by the board of directors. In addition, the Nasdaq listing standards require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the Nasdaq listing standards, a director will only qualify as an “independent director” if, in the opinion of that listed company’s board of directors, that director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Nasdaq listing standards. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the Nasdaq.

Our board of directors has undertaken a review of the independence of each of our directors. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that Katherine August-deWilde, Leslie Dach, Alan Ferber, Mary Powell, and Gerald Risk do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the Nasdaq listing standards. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Leadership Structure and Lead Independent Director

Our Corporate Governance Guidelines require that if we do not have an independent chairperson then we will appoint a lead independent director. Mr. Fenster currently serves as an executive and Executive Chairman of our board of directors. Our board of directors believes that it can benefit from Mr. Fenster’s years of experience as a founder and executive of the Company. Mr. Fenster possesses detailed in-depth knowledge of the issues, opportunities, and challenges facing us.

Our board of directors appointed Mr. Risk as the Lead Independent Director of our board of directors on June 7, 2019. Our board of directors believes that the current board leadership structure, with a strong emphasis on board independence, allows our management team to focus on our day-to-day business while allowing the Lead Independent Director to lead our board of directors in its fundamental role of providing independent advice to and oversight of management. In addition, as described below, our board has three standing committees, each member of which is an independent director. Our board delegates substantial responsibility to each committee of the board, which reports their activities and actions back to the full board. We believe that the independent committees of our board are an important aspect of the leadership structure of our board.

Board Meetings and Committees

During our fiscal year ended December 31, 2019, our board of directors held six meetings (including regularly scheduled and special meetings). During fiscal year 2019, each of our directors attended at least 75% of the meetings of the Board and committees on which he or she served as a member, with the exception of Ms. Powell due to unforeseen circumstances, including a series of special meetings called when Ms. Powell was out of the country. During 2018 and during the period from January 1, 2020 to the date of this proxy statement, Ms. Powell has otherwise had a 100% attendance record for all of our Board and Committee meetings.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we strongly encourage our directors to attend. All members of our board of directors attended our 2019 annual meeting of stockholders.

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each of the three committees of our board of directors is described below. Members will serve on these committees until their resignation or until as otherwise determined by our board of directors.

Audit Committee

Our audit committee consists of Mr. Risk, Ms. Powell and Mr. Dach, with Mr. Risk serving as the chair. Ms. Powell and Mr. Dach joined our audit committee on June 7, 2019 and April 8, 2020, respectively. Ms. August-deWilde stepped down from the Audit Committee and joined the Nominating and Corporate Governance Committee on April 8, 2020. Mr. Steve Vassallo did not seek re-election to our board of directors and his term ended on June 7, 2019.

Each member of our audit committee meets the requirements for independence and financial literacy for audit committee members under the Nasdaq listing standards and SEC rules and regulations. In addition, our board of directors has determined that Mr. Risk is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”). Our audit committee is responsible for, among other things:

•selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•helping to ensure the independence and performance of the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end results of operations;

•developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•reviewing our policies on risk assessment and risk management;

•reviewing related party transactions; and

•approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm.

Our audit committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the Nasdaq listing standards. A copy of the charter of our audit committee is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Leadership & Governance” section. During our fiscal year ended December 31, 2019, our audit committee held eight meetings.

Compensation Committee

Our compensation committee consists of Mses. August-deWilde and Powell and Mr. Ferber, with Ms. August-deWilde serving as the chair. Mr. Ferber joined our compensation committee on June 7, 2019 upon the expiration of Mr. Vassallo’s term as a member on our board of directors on June 7, 2019.

Each member of our compensation committee meets the requirements for independence for compensation committee members under the Nasdaq listing standards and SEC rules and regulations, including Rule 10C-1 under the Exchange Act. Each member of our compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code (the “Code”). Our compensation committee is responsible for, among other things:

•reviewing, approving and determining, or making recommendations to our board of directors regarding, the compensation of our executive officers;

•administering our equity compensation plans;

•reviewing, approving and making recommendations to our board of directors regarding incentive compensation and equity compensation plans;

•evaluating director compensation and making recommendations to our board of directors regarding the compensation of our directors; and

•establishing and reviewing general policies relating to compensation and benefits of our employees.

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the Nasdaq listing standards. A copy of the charter of our compensation committee is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Leadership & Governance” section. During our fiscal year ended December 31, 2019, our compensation committee held four meetings.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Ms. August-deWilde and Messrs. Ferber and Dach, with Mr. Dach serving as the chair. Ms. August-de Wilde joined the committee on April 8, 2020.

Each member of our nominating and corporate governance committee meets the requirements for independence under the Nasdaq listing standards and SEC rules and regulations. Our nominating and corporate governance committee is responsible for, among other things:

•identifying, evaluating and selecting, or making recommendations to our board of directors regarding, nominees for election to our board of directors and its committees;

•evaluating the performance of our board of directors and of individual directors;

•considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees;

•reviewing developments in corporate governance practices;

•evaluating the adequacy of our corporate governance practices and reporting;

•developing and making recommendations to our board of directors regarding corporate governance guidelines and matters; and

•reviewing the our strategies, activities, policies, and communications regarding environmental, social and governance (“ESG”) related matters.

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable Nasdaq listing standards. A copy of the charter of our nominating and corporate governance committee is available on our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Leadership & Governance” section. During our fiscal year ended December 31, 2019, our nominating and corporate governance committee held two meetings.

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, Mses. August-deWilde and Powell and Mr. Ferber served as members of our compensation committee. Mr. Ferber joined our compensation committee on June 7, 2019, upon the expiration of Mr. Vassallo’s term on our board of directors on June 7, 2019. None of the members of our compensation committee is or has been an officer or employee of our company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our board of directors or compensation committee.

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our nominating and corporate governance committee will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, issues of character, integrity, judgment, diversity, independence, area of expertise, corporate experience, length of service, potential conflicts of interest and other commitments. Nominees must also have the ability to offer advice and guidance to our Chief Executive Officer based on past experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Director candidates must have sufficient time available in the judgment of our nominating and corporate governance committee to perform all board of director and committee responsibilities. Members of our board of directors are expected to prepare for, attend, and participate in all board of director and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

Although our board of directors does not maintain a specific policy with respect to board diversity, our board of directors believes that our board of directors should be a diverse body, and our nominating and corporate governance committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, our nominating and corporate governance committee may take into account the benefits of diverse viewpoints. Our nominating and corporate governance committee also considers these and other factors as it oversees the annual board of director and committee evaluations. After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection.

Stockholder Recommendations for Nominations to the Board of Directors

Our nominating and corporate governance committee will consider candidates for director recommended by stockholders holding at least one percent (1%) of the fully diluted capitalization of our company continuously for at least twelve (12) months prior to the date of the submission of the recommendation, so long as such recommendations comply with our amended and restated certificate of incorporation and amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws, our policies and procedures for director candidates, as well as the regular director nominee criteria described above. This process is designed to ensure that our board of directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should contact our General Counsel or our Legal Department in writing. Such recommendations must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate confirming willingness to serve on our board of directors. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Any nomination must comply with the requirements set forth in our bylaws and should be sent in writing to our Secretary at Sunrun Inc., 225 Bush Street, Suite 1400, San Francisco, CA 94104. To be timely for our 2021 annual meeting of stockholders, our Secretary must receive the nomination no earlier than February 1, 2021 and no later than March 3, 2021.

Communications with the Board of Directors

Interested parties wishing to communicate with our board of directors or with individual members of our board of directors may do so by writing to our board of directors or to the particular members of our board of directors, and mailing the correspondence to our General Counsel at Sunrun Inc., 225 Bush Street, Suite 1400, San Francisco, CA 94104. Our General Counsel, in consultation with appropriate members of our board of directors as necessary, will review all incoming communications and, if appropriate, such communications will be forwarded to the appropriate member or members of our board of directors, or if none is specified, to the Chairman of our board of directors.

ESG (Environmental, Social and Governance)

At Sunrun, sustainability is core to our business model and our corporate culture. We embed best practices for environmental, social, and governance (“ESG”) performance throughout our organization and publish an annual Sunrun Impact Report, disclosing our performance using various widely accepted frameworks, including the Global Reporting Initiative (“GRI”) guidelines. ESG performance and reporting is overseen internally by our ESG Committee of senior management and at the board level by our Nominating & Corporate Governance Committee. Highlights of our ESG initiatives include the following:

•We are already a deeply carbon negative company, and we seek to help our customers and partners become carbon negative as well. Our solar systems have prevented greenhouse gas emissions totaling 5.2 million metric tons of carbon dioxide equivalent, which is an amount comparable to eliminating more than 13 billion passenger vehicle miles or comparable to the emissions prevented by not burning approximately 5 billion pounds of coal.

•In 2018, Sunrun committed to develop a minimum of 100 megawatts of solar on affordable multi-family housing, where 80% of tenants fall below 60% of the area median income, during the next decade. This commitment will directly benefit at least 50,000 households, and we intend to expand these programs in other states.

•Sunrun works with vendors that share our commitment to creating a better, greener, and kinder planet. That is why we included policies on environmental protection and sustainability as well as responsible mineral sourcing in our Vendor Code of Conduct, which was adopted in 2019.

•We were the first national solar company to achieve 100% gender pay parity in 2018.

•We strive to create an open and inclusive culture where everyone’s unique backgrounds, thoughts, experiences and abilities are welcomed, valued, respected and celebrated. Women comprised 43% of Sunrun’s Board of Directors and 50% of our senior management team in 2019. Our organizational leadership included approximately 30% women. Approximately 25% of all Sunrun employees are women.

•Sunrun is dedicated to providing training, education, and development to all of our employees. We offer cross-functional training, beginning with new-hire orientation and covering all levels up to advanced leadership training for senior managers.

To learn more about our ESG efforts, please see our annual Sunrun Impact Report at investors.sunrun.com, which we expect to update after the date of this proxy statement. (The inclusion of any website address in this proxy statement does not incorporate by reference the information on or accessible through the website into this proxy statement.)

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics is posted on the Corporate Governance portion of our website at www.sunrun.com on the “Governance Documents” page under the “Investors – Leadership & Governance” section. We will post amendments to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers on the same website.

Risk Management

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, political, regulatory, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed.

Our board of directors believes that open communication between management and our board of directors is essential for effective risk management and oversight. Our board of directors meets with our Chief Executive Officer and other members of the senior management team at quarterly meetings of our board of directors, where, among other topics, they discuss strategy and risks facing the company, as well as at such other times as they deem appropriate.

While our board of directors is ultimately responsible for risk oversight, our board committees assist our board of directors in fulfilling its oversight responsibilities in certain areas of risk. Our audit committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, and discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our audit committee also reviews our major financial risk exposures and the steps management has taken to monitor and control these exposures. Our audit committee also monitors certain key risks on a regular basis throughout the fiscal year, such as risk associated with internal control over financial reporting and liquidity risk. Our nominating and corporate governance committee assists our board of directors in fulfilling its oversight responsibilities with respect to the management of risk associated with board organization, membership and structure, and corporate governance. Our compensation committee assesses risks created by the incentives inherent in our compensation policies. Finally, our full board of directors reviews strategic and operational risks in the context of reports from the management team, receives reports on significant committee activities, and evaluates the risks inherent in significant transactions.

Director Compensation

We have a non-employee director pay policy pursuant to which our unaffiliated, non-employee directors are eligible to receive equity awards and annual cash compensation for service on our board of directors and committees of our board of directors.

As of January 1 ,2019, our non-employee directors were entitled to receive the following cash compensation for their services under our non-employee director pay policy:

•$50,000 per year for service as a board member;

•$25,000 per year for service as chair of the audit committee;

•$10,000 per year for service as chair of the compensation committee;

•$5,000 per year for service as chair of the nominating and corporate governance committee; and

•$10,000 per year for service as a non-chairperson member of the audit committee.

All cash payments to non-employee directors are paid quarterly and newly hired directors receive a pro-rata cash fee.

In March 2019, with the assistance of our compensation consultant, Meridian Compensation Partners, LLC (“Meridian”), we analyzed our non-employee director compensation practices. Meridian advised that our non-employee director pay was well below the median of our peer group. Accordingly, in March 2019 we amended and restated our non-employee director compensation policy to increase the cash compensation payable to our non-employee directors in order to approximate the median of our peer group. Commencing upon the adoption of our amended and restated non-employee director pay policy on March 25, 2019, our non-employee directors were entitled to receive the following cash compensation for their services:

•$50,000 per year for service as a board member;

•$25,000 per year for service as the lead independent director;

•$25,000 per year for service as chair of the audit committee;

•$15,000 per year for service as chair of the compensation committee;

•$10,000 per year for service as chair of the nominating and corporate governance committee;

•$10,000 per year for service as a non-chairperson member of the audit committee;

•$7,500 per year for service as a non-chairperson member of the compensation committee; and

•$5,000 per year for services as a non-chairperson member of the nominating and corporate governance committee.

Equity Compensation

Under our non-employee director compensation policy, each non-employee director who is serving on January 1st of an applicable fiscal year will receive an annual restricted stock unit (“RSU”) award on such date, or the next trading day if January 1st is not a trading date, with the number of shares subject to the RSU award determined based on a specified dollar value and the closing trading price of our stock on the date of grant. Newly appointed or elected non-employee directors receive on the date of their initial appointment or election a pro-rated RSU grant their first year of service, with the number of shares subject to the RSU award determined in proportion to the length of active service expected to be provided by such non-employee director during his or her first fiscal year of service. These RSU awards vest 100% on January 1st the year following the date of grant, subject to the non-employee directors’ continued service on our board of directors through the vesting date. For 2019, under our amended and restated non-employee director pay policy, our non-employee directors were each granted an RSU award having a value of $155,000 (or the applicable pro-rated value), as determined on the applicable date of grant.

Director Compensation for Fiscal Year 2019

The following table sets forth a summary of the compensation received by our non-employee directors during our fiscal year ended December 31, 2019:

| | | | | | | | | | | | | | | | | | | | |

Director | | Fees Earned or Paid in Cash ($) | | Stock Awards ($) (1) | | Total ($) |

Katherine August-deWilde (2) | | $ | 71,250 | | | $ | 154,992 | | | $ | 226,242 | |

Leslie Dach (2) | | $ | 60,000 | | | $ | 154,992 | | | $ | 214,992 | |

Alan Ferber (2) | | $ | 57,955 | | | $ | 154,992 | | | $ | 212,947 | |

Mary Powell (2) | | $ | 61,243 | | | $ | 154,992 | | | $ | 216,235 | |

Gerald Risk (2) | | $ | 89,092 | | | $ | 154,992 | | | $ | 244,084 | |

Steve Vassallo (3) | | $ | 38,125 | | | $ | 154,992 | | | $ | 193,117 | |

______________________

(1)The amounts reported in the Stock Awards column represent the grant date fair value of the stock awards granted to the non-employee directors during 2019 as computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 Compensation Stock Compensation or ASC 718. Note that the amounts reported in the column reflect the accounting cost for these stock awards, and do not correspond to the actual economic value that may be received by the non-employee directors from the stock awards.

(2)Equity incentive awards outstanding as of December 31, 2019 for each non-employee director were as follows: (i) Ms. August-deWilde had 13,013 shares issuable pursuant to RSUs which 100% vested on January 1, 2020, (ii) Mr. Dach had 13,013 shares issuable pursuant to RSUs which 100% vested on January 1, 2020 and 100,000 vested stock options, (iii) Mr. Ferber had 13,013 shares issuable pursuant to RSUs which 100% vested on January 1, 2020, (iv) Ms. Powell had 13,013 shares issuable pursuant to RSUs which 100% vested on January 1, 2020, and (v) Mr. Risk had 13,013 shares issuable pursuant to RSUs which 100% vested on January 1, 2020 and 120,000 vested stock options.

(3)Mr. Vassallo did not stand for re-election to our board of directors, and his term ended on June 7, 2019.

Our directors who are also our employees receive no additional compensation for their service as directors. During our fiscal year ended December 31, 2019, Lynn Jurich and Edward Fenster were our employees. See the section titled “Executive Compensation” for additional information about the compensation paid to Ms. Jurich and Mr. Fenster.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our board of directors is currently composed of seven members. In accordance with our amended and restated certificate of incorporation, our board of directors is divided into three staggered classes of directors. At the Annual Meeting, three Class II directors will be elected for a three-year term to succeed the three Class II directors whose term is then expiring.

Each director’s term continues until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control of our company.

Nominees

Our nominating and corporate governance committee has recommended, and our board of directors has approved, Leslie Dach, Edward Fenster and Mary Powell as nominees for election as Class II directors at the Annual Meeting. If elected, Messrs. Dach and Fenster and Ms. Powell will serve as Class II directors until our 2023 annual meeting of stockholders. Each of the nominees is currently a director of our company. For information concerning the nominees, please see the section titled “Board of Directors and Corporate Governance.”

If you are a stockholder of record and you sign your proxy card or vote by telephone or over the Internet but do not give instructions with respect to the voting of directors, your shares will be voted “FOR” the election of Messrs. Dach and Fenster and Ms. Powell. We expect that each of Messrs. Dach and Fenster and Ms. Powell will accept such nomination; however, in the event that a director nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by our board of directors to fill such vacancy. If you are a street name stockholder and you do not give voting instructions to your broker or nominee, your broker will leave your shares unvoted on this matter.

Vote Required

The election of directors requires a plurality vote of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Broker non-votes and abstentions will have no effect on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES NAMED ABOVE.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed Ernst & Young LLP (“EY”), independent registered public accountants, to audit our consolidated financial statements for our fiscal year ending December 31, 2020. During our fiscal year ended December 31, 2019, EY served as our independent registered public accounting firm.

Notwithstanding the appointment of EY and even if our stockholders ratify the appointment, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our audit committee believes that such a change would be in the best interests of our company and our stockholders. At the Annual Meeting, our stockholders are being asked to ratify the appointment of EY as our independent registered public accounting firm for our fiscal year ending December 31, 2020. Our audit committee is submitting the appointment of EY to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of EY will be present at the Annual Meeting, and they will have an opportunity to make a statement and will be available to respond to appropriate questions from our stockholders.

If our stockholders do not ratify the appointment of EY, our board of directors may reconsider the appointment.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees for professional audit services and other services rendered to our company by EY for our fiscal years ended December 31, 2019 and 2018.

| | | | | | | | | | | | | | |

| | 2019 | | 2018 |

Audit Fees (1) | | $ | 4,184,000 | | | $ | 6,463,000 | |

Audit-Related Fees | | — | | | — | |

Tax Fees | | — | | | — | |

All Other Fees (2) | | 1,995 | | | 1,995 | |

Total Fees | | $ | 4,185,995 | | | $ | 6,464,995 | |

______________________

(1) Audit fees for 2019 and 2018 consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements, including fees related to adoptions of the new revenue and lease standards, estimated fees for audits of investment funds to be performed and review of our quarterly consolidated financial statements and assistance with and review of documents filed with the SEC. Audit fees for 2019 also include fees for professional services provided in connection with EY’s report on internal controls over financial reporting for the consolidated financial statements.

(2) All other fees consist of fees for accessing EY’s online research database.

Auditor Independence

In our fiscal year ended December 31, 2019, there were no other professional services provided by EY that would have required our audit committee to consider their compatibility with maintaining the independence of EY.

Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our audit committee has established a policy governing our use of the services of our independent registered public accounting firm. Under this policy, our audit committee is required to pre-approve all audit and non-audit services performed by our independent registered public accounting firm in order to ensure that the provision of such services does not impair the public accountants’ independence. All fees paid to EY for our fiscal years ended December 31, 2019 and 2018 were pre-approved by our audit committee.

Vote Required

The ratification of the appointment of EY as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a vote AGAINST the proposal and broker non-votes will have no effect.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP.

PROPOSAL NO. 3

ADVISORY VOTE ON THE COMPENSATION

OF OUR NAMED EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Section 14A of the Exchange Act, our stockholders are entitled to vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules.

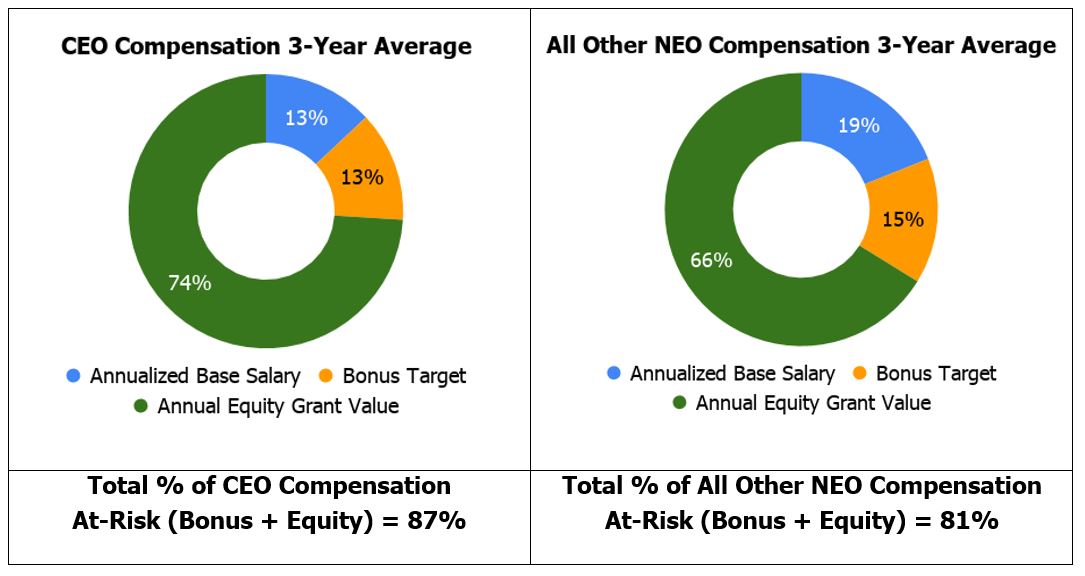

This proposal, commonly known as a “Say-on-Pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation as a whole. This vote is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this proxy statement. The compensation of our named executive officers is disclosed in the Compensation Discussion and Analysis, the compensation tables, and the related narrative disclosure contained in this proxy statement. As discussed in these disclosures, we believe that our compensation policies and decisions are based on principles that reflect a “pay-for-performance” philosophy and are strongly aligned with our stockholders’ interests and consistent with current market practices. Compensation of our named executive officers is designed to enable us to attract and retain talented and experienced executives to lead us successfully in a competitive environment.

Accordingly, our board of directors is asking our stockholders to indicate their support for the compensation of our named executive officers, as described in this proxy statement, by casting a non-binding advisory vote “FOR” the following resolution:

“RESOLVED, that the stockholders of Sunrun Inc. (the “Company”) approve, on an advisory basis, the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Securities and Exchange Commission Regulation S-K, including the Compensation Discussion and Analysis, the compensation tables, narrative disclosures, and other related disclosure.”

Vote Required

Advisory approval of this Proposal No. 3 requires the vote of the holders a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote thereon.

Because the vote is advisory, it is not binding on us, our compensation committee or our board of directors. Nevertheless, the views expressed by the stockholders, whether through this vote or otherwise, are important to management and our board of directors and, accordingly, the board of directors and the compensation committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

REPORT OF THE AUDIT COMMITTEE

The audit committee is a committee of the board of directors comprised solely of independent directors as required by the Nasdaq listing standards and rules and regulations of the SEC. The audit committee operates under a written charter approved by the board of directors, which is available on the company’s website at www.sunrun.com on the “Governance Documents” page under the “Investors – Leadership & Governance” section. The composition of the audit committee, the attributes of its members and the responsibilities of the audit committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The audit committee reviews and assesses the adequacy of its charter and the audit committee’s performance on an annual basis.

With respect to the company’s financial reporting process, the management of the company is responsible for (1) establishing and maintaining internal controls and (2) preparing the company’s consolidated financial statements. The company’s independent registered public accounting firm, Ernst & Young LLP (“EY”), is responsible for auditing these financial statements. It is the responsibility of the audit committee to oversee these activities. It is not the responsibility of the audit committee to prepare the company’s financial statements. These are the fundamental responsibilities of management. In the performance of its oversight function, the audit committee has:

• reviewed and discussed the audited financial statements with management and EY;

• discussed with EY the matters required to be discussed by the Statement on Auditing Standards No. 1301, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), and as adopted by the Public Company Accounting Oversight Board in Rule 3200T; and

• received the written disclosures and the letter from EY required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with EY its independence.

Based on the audit committee’s review and discussions with management and EY, the audit committee recommended to the board of directors that the audited financial statements be included in the Annual Report on Form 10‑K for the fiscal year ended December 31, 2019 for filing with the Securities and Exchange Commission (“SEC”).

Respectfully submitted by the members of the audit committee of the board of directors:

Gerald Risk (Chair)

Katherine August-deWilde (1)

Mary Powell