Filed by Sunrun Inc.

Pursuant to Rule 425

under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14d-2

under the Securities Exchange Act of 1934, as amended

Subject Company: Vivint Solar, Inc.

(Commission File No. 001-36642)

The following article by Business Insider on August 20, 2020 was made available in connection with the acquisition of Vivint Solar, Inc. (“Vivint Solar”) by Sunrun Inc. (“Sunrun”):

The inside story of how a historic $3.2 billion deal between rival solar giants Sunrun and Vivint Solar came together—and why it could transform the future of power generation

| • | Sunrun in July agreed to buy its rival Vivint Solar for $3.2 billion, the largest merger in the history of the residential solar industry. |

| • | While the deal happened over a few short months and countless video calls, Sunrun had been thinking about partnering with Vivint for nearly four years. |

| • | “Back in the 2016 time frame, I think we both recognized that the two companies have really complementary customer reach,” Sunrun CEO Lynn Jurich told Business Insider. |

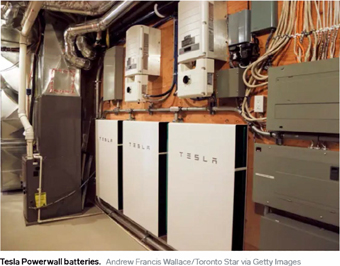

| • | Jurich said Sunrun had big plans following the merger, including building out its fleet of batteries and turning them into virtual power plants that can replace fossil-fuel-based electricity sources. |

| • | Through interviews with Sunrun’s CEO and chief financial officer, in addition to a recent public filing, we pieced together how the deal came together. |

The race to buy Vivint Solar was bound, almost entirely, by a few short months during the coronavirus pandemic.

Beginning at the start of the year, the Utah-based solar giant whittled 24 prospective bidders down to five serious buyers. And by summer, there was just one winner: Sunrun, the nation’s largest rooftop-solar company.