Exhibit 10.16

EXECUTION COPY

AGREEMENT OF SUBLEASE

THIS AGREEMENT OF SUBLEASE (“Sublease”) is made as of the 1st day of April, 2013 (the “Effective Date”) by and between VISA U.S.A. INC., a Delaware corporation (“Sublandlord”) and SUNRUN INC., a Delaware corporation (“Subtenant”).

RECITALS

A. Sublandlord is the tenant under that certain Lease dated November 17, 2008, by and between Sublandlord and 595 MARKET STREET, INC., a Delaware corporation (“Prime Landlord”), a copy of which Lease is attached hereto as Exhibit A (as it may be amended or modified from time to time, the “Prime Lease”).

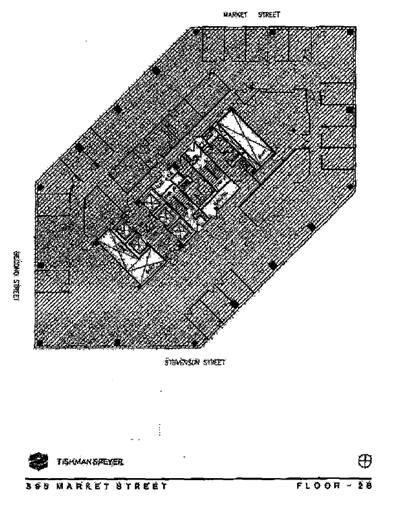

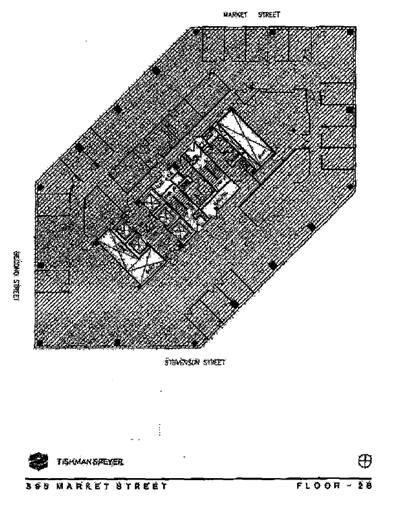

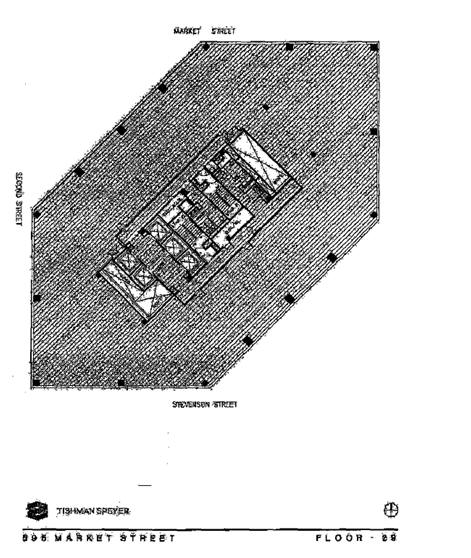

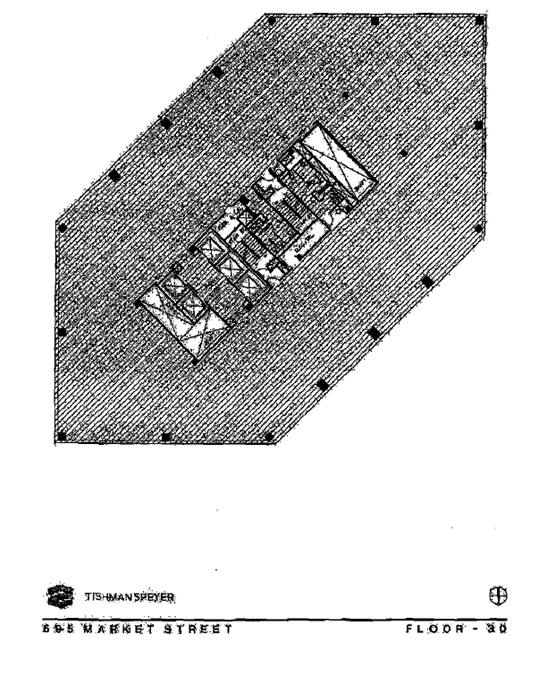

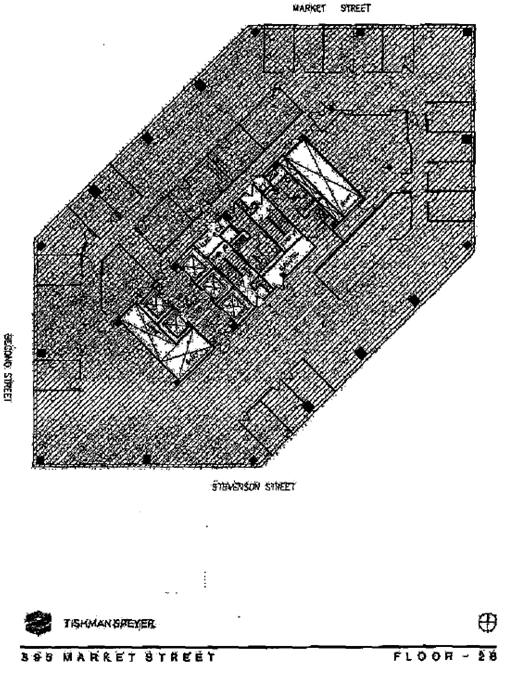

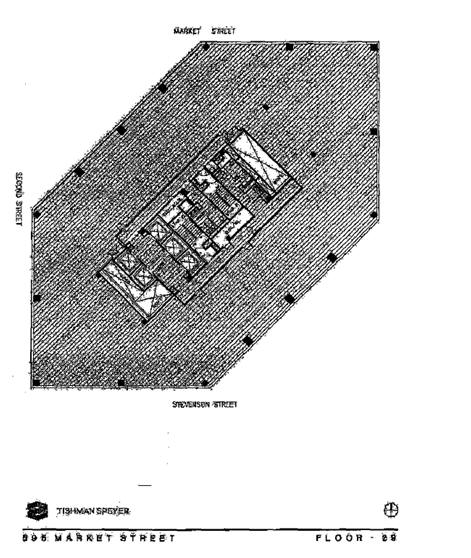

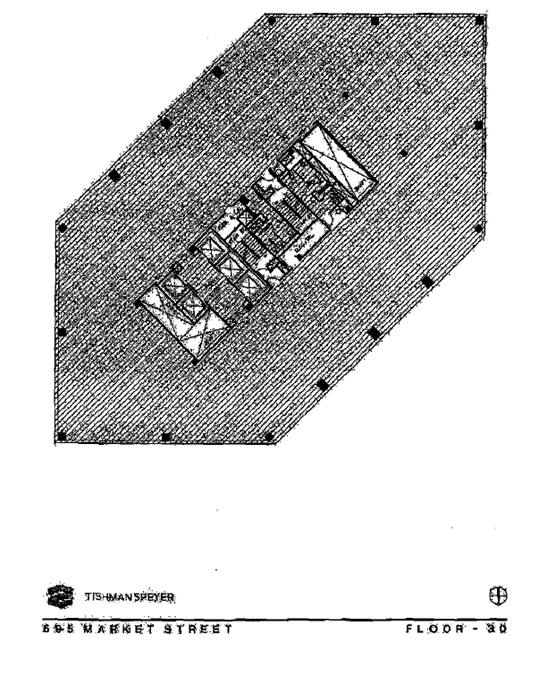

B. The Prime Lease sets forth the terms and conditions of Sublandlord’s tenancy respecting approximately 43,842 rentable square feet of office space in the Building (as defined in the Prime Lease) (the “Prime Lease Premises”), consisting of (i) 14,604 rentable square feet on the twenty-eighth floor, (ii) 14,664 rentable square feet on the twenty-ninth floor, and (iii) 14,574 rentable square feet on the thirtieth floor; the Prime Lease Premises consist of the entirety of the twenty eighth, twenty ninth and thirtieth floors of the Building as more particularly shown on Exhibit A to the Prime Lease.

C. Subject to the terms and conditions of the Prime Lease, Subtenant desires to sublease from Sublandlord, and Sublandlord desires to sublease to Subtenant, the entire Prime Lease Premises on the terms and conditions hereinafter set forth.

NOW, THEREFORE, Sublandlord and Subtenant, in consideration of the foregoing recitals which are incorporated herein by reference and the mutual promises and covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and each with intent to be legally bound, for themselves and their respective successors and permitted assigns, agree as follows:

1. Definitions. All terms not expressly defined in this Sublease shall have the meanings given to them in the Prime Lease. For all purposes of this Sublease, except as otherwise expressly provided or unless the context otherwise requires: (i) the terms defined include the plural as well as the singular, (ii) all accounting terms not otherwise defined herein or in the Prime Lease have the meanings assigned to them in accordance with generally accepted accounting principles as are at the time applicable, (iii) all references in this Sublease to designated “Articles,” “Sections” and other subdivisions are to the designated Articles, Sections and other subdivisions of this Sublease, (iv) the words “herein,” “hereof” and “hereunder” and other words of similar import refer to this Sublease as a whole and not to any particular Article, Section or other subdivision, (v) the words “include” and “including” shall mean “including without limitation”, (vi) the term “and/or” is to be construed to mean that both cases apply or, either the first or the second case applies, as the circumstances may require, and (vii) the term “attorneys’ fees” (or any variation thereof) includes all court costs, disbursements and expert fees incurred by the party retaining such attorney. If there be more than one person comprising Sublandlord or Subtenant, then the obligations hereunder imposed upon such persons shall be joint and several. All pronouns and variations thereof shall be deemed to refer to the masculine, feminine and neuter, as the identity of the party or parties may require.

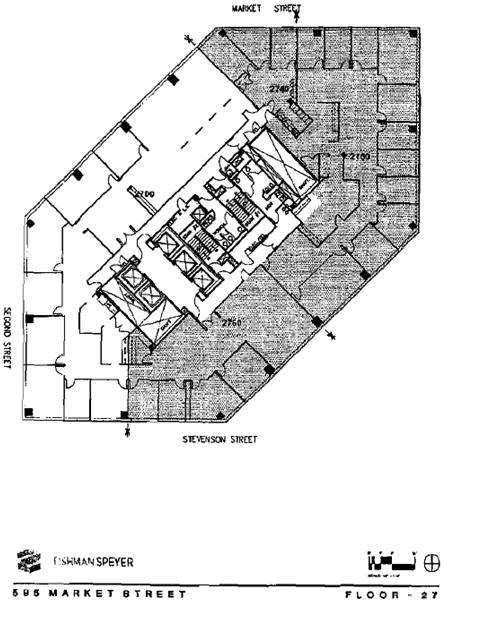

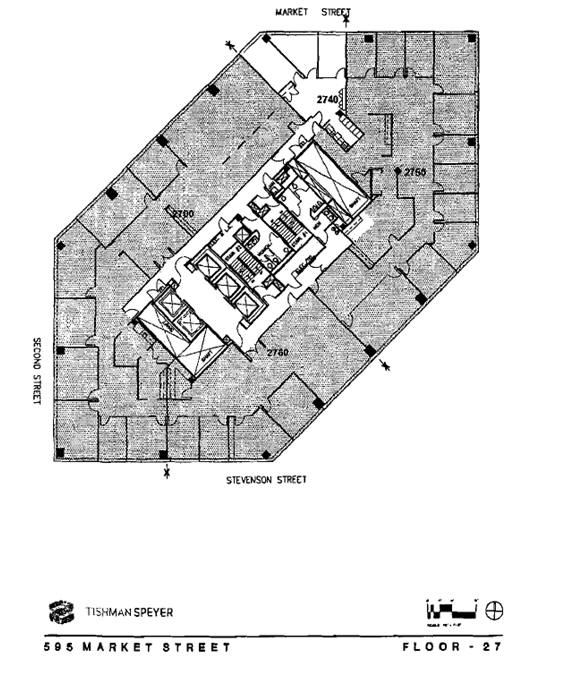

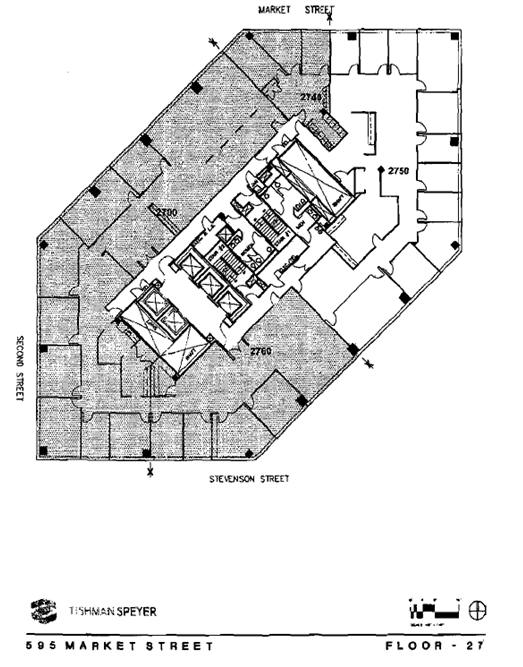

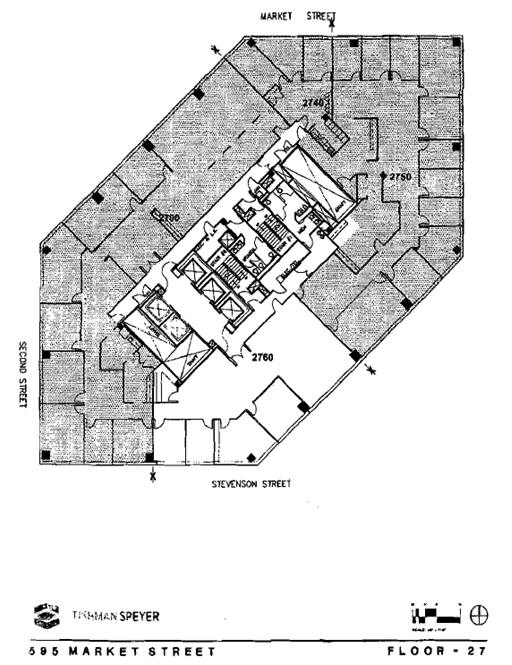

2. Premises. For the Term (as hereinafter defined) and upon the conditions hereinafter provided, Sublandlord hereby agrees to sublease to Subtenant, and Subtenant hereby agrees to sublease from Sublandlord, the entire Prime Lease Premises, as shown on the floor plans attached hereto as Exhibit B (the “Premises”). The parties hereby agree that for all purposes of this Sublease the Premises shall be deemed to consist of 43,842 rentable square feet of office space. On the Commencement Date (as defined in Section 4), Sublandlord will deliver possession of the Premises to Subtenant (subject to Sublandlord’s right of entry to remove Sublandlord’s Furniture (as defined in Section 3) therefrom as described below and to the terms of the Prime Lease and this Sublease). In addition to Subtenant’s rights as set forth herein to occupy the Premises, if permitted by Prime Landlord and subject to availability of roof space, Subtenant shall also be entitled to Sublandlord’s rights to install Telecommunications Equipment in accordance with and subject to Section 26.23 of the Prime Lease. Subtenant shall obtain Sublandlord’s approval (not to be unreasonably withheld) of the proposed equipment type, size and frequency prior to making a request for approval to Prime Landlord. Sublandlord agrees to use reasonable efforts, at Subtenant’s expense, to procure Prime Landlord’s consent to Subtenant’s right to install such Telecommunications Equipment; provided, however, that the failure of Prime Landlord to consent to Subtenant’s installation of such Telecommunications Equipment shall not affect the validity of this Sublease. Subtenant shall be solely responsible for the cost and expense of installation, maintenance and removal of such Telecommunications Equipment.

3. Condition of Premises. Subtenant acknowledges that Sublandlord has made no representations or warranties with respect to the Building or the Premises or any personal property of Sublandlord included with the Premises, including the cabling referenced in Section 8 below. Subtenant hereby agrees to accept the Premises and any such personal property (including the cabling referenced in Section 8 below) in its “AS IS” and “with all faults” condition existing on the date possession is delivered to Subtenant, without requiring any alterations, improvements, repairs, maintenance, replacements, restoration or decorations to be made by Sublandlord, or at Sublandlord’s expense, either at the time possession is given to Subtenant or during the entire Term of this Sublease. Sublandlord makes no representations regarding the condition of the Premises or any personal property (including the cabling referenced in Section 8 below) or the suitability of the Premises or such property for Subtenant’s purposes. Sublandlord shall remove all cubicles and ancillary furniture described on Exhibit D (“Sublandlord’s Furniture”) within seven (7) days following the Commencement Date. On the expiration of the Term, Sublandlord shall sell all of the remaining existing private office, reception, kitchen and conference room furniture, fixtures and equipment described on Exhibit D-1 (“FFE”) to Subtenant for $1.00 pursuant to a Bill of Sale in the form attached hereto as Exhibit D-2. During the Term, Subtenant shall have the right to use the FFE in the normal course of its business and Subtenant agrees to maintain the FFE in good condition and repair, subject to reasonable wear and tear. Subtenant shall not remove any of the FFE from the Premises without Sublandlord’s prior written approval, which will not be unreasonably withheld, conditioned or delayed; provided, however, that (a) Sublandlord’s consent will not be required with respect to the removal from the Premises of any item of FFE if such item is to be stored in a commercial storage facility and Subtenant provides Sublandlord with notice of such removal, a list of the items to be removed and the name, address and unit number of the commercial storage facility and (b) if Sublandlord fails to notify Subtenant of Sublandlord’s consent, or denial of consent, to a proposed removal or disposition of any item of FFE which requires Sublandlord’s consent within fifteen (15) days following Subtenant’s request for such consent, Sublandlord will be deemed to have consented to such removal and/or disposition.

-2-

4. Term.

(a) The term of this Sublease (the “Term”) shall commence on the later of (i) the date on which Subtenant delivers the Security Deposit (as defined below) to Sublandlord and (ii) the date on which the Prime Landlord consents to this Sublease as provided in Section 27 hereof and as required by the Prime Lease (the later of such dates being the “Commencement Date”) and shall end on July 31, 2019 (“Expiration Date”), subject to any termination on such earlier date upon which the Term may be terminated pursuant to any of the conditions or limitations or other provisions of this Sublease or pursuant to law. Subtenant will not occupy any portion of the Premises for the conduct of its business until Substantial Completion of the Subtenant’s Improvements (as defined in Section 9(c)).

(b) The parties acknowledges that the Expiration Date is thirty (30) days prior to the “Expiration Date” under the Prime Lease. Notwithstanding the Expiration Date set forth in Section 4 (a) above, the Term shall be automatically extended through August 31, 2019, the scheduled “Expiration Date” of the Prime Lease, which shall be deemed to be the Expiration Date for all purposes of this Sublease if (i) Subtenant enters into a binding lease agreement with Prime Landlord providing for Subtenant to occupy the Premises on a “direct” basis beyond the Expiration Date (a “Direct Lease”), (ii) Subtenant obtains a release from Prime Landlord of any liability or obligation of Sublandlord with respect to the removal of any Tenant Improvements and Tenant Property under the terms of the Prime Lease (including any cabling and conduit installed by Sublandlord under Section 10.10 of the Prime Lease) and any restoration or repair in connection with such removal, reasonably satisfactory to Sublandlord (“Release”); (iii) Subtenant provides a copy of such Direct Lease and the original of the Release to Sublandlord prior to June 30, 2019; and (iv) Subtenant is not in breach of the terms of this Sublease as of June 30, 2019.

(c) This Sublease shall automatically terminate if the Prime Lease is terminated or the term thereof expires.

5. Rent.

(a) Commencing on the earlier of (i) Substantial Completion of the Subtenant’s Improvements, (ii) Subtenant’s occupancy of any portion of the Premises for the conduct of its business (as opposed to the construction of Subtenant’s Improvements and/or the installation of Subtenant’s furniture, fixtures, cabling and equipment), or (iii) November 1, 2013 (the “Rent Commencement Date”) and continuing through the Expiration Date, the base rent payable by Subtenant hereunder (“Base Rent”) shall be Forty Five Dollars ($45.00) per rentable square foot of office space in the Premises per annum and such amount shall increase by One Dollar ($1.00) per rentable square foot of office space in the Premises per annum on the first day of each Lease Year. As used herein the term “Lease Year” shall mean the twelve (12) month period commencing on the Rent Commencement Date; provided, however, that if the Rent Commencement Date is not the first day of a calendar month then the first Lease Year shall be twelve (12) full calendar months plus the partial month in which the Rent Commencement Date occurs. A schedule of Subtenant’s Base Rent obligations is set forth below:

-3-

| Period During Term |

Per Annum | Per Month | Annual Base Rent Per Rentable Square Foot |

|||||||||

| First Lease Year |

$ | 1,972,890.00 | $ | 164,407.50 | $ | 45.00 | ||||||

| |

(plus any partial month) |

|

||||||||||

| Second Lease Year |

$ | 2,016,732.00 | $ | 168,061.00 | $ | 46.00 | ||||||

| Third Lease Year |

$ | 2,060,574.00 | $ | 171,714.50 | $ | 47.00 | ||||||

| Fourth Lease Year |

$ | 2,104,416.00 | $ | 175,368.00 | $ | 48.00 | ||||||

| Fifth Lease Year |

$ | 2,148,258.00 | $ | 179,021.50 | $ | 49.00 | ||||||

| Sixth Lease Year (to Expiration Date) |

$ | 2,192,100.00 | $ | 182,675.00 | $ | 50.00 | ||||||

Promptly following the determination of the Rent Commencement Date, Sublandlord and Subtenant will mutually execute and deliver a letter agreement in the form of Exhibit E attached hereto (the “Confirmation Letter”), confirming the Rent Commencement Date and the Abatement Period (defined below); provided that failure of either party to execute such Confirmation Letter shall not affect the validity of this Sublease.

(b) Base Rent shall be due in advance and without notice or demand, in equal monthly installments on the first day of each calendar month following the Rent Commencement Date and thereafter during the Term, except that the first month’s Base Rent (or a proportionate part thereof if the Rent Commencement Date is not the first day of a calendar month) shall be due and payable on the Rent Commencement Date.

(c) Notwithstanding anything in this Sublease to the contrary, provided that Subtenant is not in breach of this Sublease after the expiration of any applicable notice and cure period provided for under Section 13 below (hereinafter, “Default”), Subtenant shall not be obligated to pay monthly Base Rent for the Premises for the first three (3) full calendar months after the Rent Commencement Date (the “Abatement Period”) and for the last one (1) month of the Term (the “Abatement Month”). For avoidance of doubt, if the Rent Commencement Date occurs on a date other than the first day of a month, Subtenant shall pay the proportionate amount for the remainder of the calendar month as provided in Subsection 5(b) and the Abatement Period shall commence on the first day of the following calendar month.

6. Passthroughs of Taxes and Operating Expenses.

(a) Commencing on the first day of the Second Lease Year, Taxes and Operating Expenses shall be passed through to Subtenant on the same basis as described in Article 7 of the Prime Lease, except that the “Base Year” for purposes of this Sublease shall be the calendar year 2013 (subject to Section 18 hereof). Subtenant agrees to pay to Sublandlord, as

-4-

Additional Rent (as defined below) under this Sublease, 100% of the amount payable by Sublandlord pursuant to the Article 7 of the Prime Lease entitled “Increases in Taxes and Operating Expenses” to the extent in excess of Sublandlord’s Tax Payment and Operating Expense Payment, respectively, for the calendar year 2013 (subject to Section 18 hereof), calculated based upon the Base Year described above, which will constitute “Base Taxes” and “Base Operating Expenses” for the purposes of this Sublease. Such payments shall be made as and when due under the Prime Lease, including without limitation, the payment in advance and in equal monthly installments of all estimate payments and of all adjustment payments as referenced in Sections 7.2 and 7.3 of the Prime Lease. Sublandlord agrees to deliver to Subtenant any Tax Estimate and/or Expense Estimate promptly following Sublandlord’s receipt of such Estimates from Prime Landlord and to include in any such delivery an estimate of Subtenant’s payments required hereunder, as well as each Statement received by Sublandlord from Prime Landlord (the Statement with respect to the calendar year 2013 will, subject to Sublandlord’s rights under Section 7.4(b) of the Prime Lease and Section 18 hereof, establish the Base Operating Expenses and Base Taxes for the purposes of this Sublease).

(b) Subtenant shall also pay to Sublandlord, as Additional Rent,(i) all charges for any additional services provided to Subtenant, including, without limitation, charges and fees for after-hours heating and air-conditioning services, late charges and interest, overtime or excess service charges, including excess electrical usage, and (ii) damages and interest and charges related to Subtenant’s failure to perform its obligations under this Sublease; all such payments shall be due as and when due under the Prime Lease. All requests for additional services shall be made through Sublandlord; provided, however, that Sublandlord agrees, at Subtenant’s expense, to use reasonable efforts to cooperate with Subtenant and Prime Landlord to establish a procedure whereby so long as Subtenant is not in breach under the terms of this Sublease, any requests by Subtenant for additional services (including after-hours utilities) may be promptly delivered to Prime Landlord in order to ensure Subtenant’s ability to timely receive such services. In connection therewith, Sublandlord will not unreasonably withhold its consent to a procedure whereby Subtenant requests such services and/or utilities directly from Prime Landlord (with a copy of such request sent simultaneously to Sublandlord) if Prime Landlord consents to such a procedure and to direct billing to and payment by Subtenant for such additional services and/or utilities.

7. Payment; Survival:

(a) All sums of money (other than Base Rent) due and payable by Subtenant under this Sublease are hereinafter referred to as “Additional Rent”. As used herein, the term “Rent” means the Base Rent and the Additional Rent. All Rent shall be paid in lawful money of the United States of America without notice or demand therefor (except for such notice as may be specifically required under the terms of this Sublease in the case of certain payments of Additional Rent under Article 6) and without any deductions, set-off or abatement whatsoever; except as specifically provided in Section 16. Rent shall be paid at the address of Sublandlord set forth in Section 28 below, or such other address as Sublandlord shall designate in written notice to Subtenant from time to time. Time is of the essence for all Rent due dates under this Sublease. Any Rent payment received by Sublandlord later than the due date specified in this Sublease shall bear interest from the date such payment became due until paid at the Interest Rate. In any case where payment is required under this Sublease and a specific time period is not set forth for making such payment, the payment shall be due within thirty (30) days of the date a bill is rendered for such payment.

-5-

(b) The receipt and retention by Sublandlord of monthly Base Rent or Additional Rent from Subtenant or anyone else shall not be deemed a waiver of the breach by Subtenant of any covenant, agreement, term or provision of this Sublease, or as the acceptance of such other person as a subtenant, or as a release of Subtenant from the further keeping, observance or performance by Subtenant.

(c) Subtenant’s obligation to pay the Rent, as well as Sublandlord’s obligation to pay any applicable amount following any applicable reconciliation of Operating Expenses and/or Taxes under the terms of the Prime Lease, to the extent not paid as of the date of expiration or termination hereof, shall survive such expiration or termination of this Sublease.

8. Use. The Premises shall be used for those purposes permitted under the Prime Lease and for no other purpose. Sublandlord agrees that, subject to the terms of the Prime Lease and any agreements with AT&T or other providers, Subtenant will have the right to use any cabling installed by Sublandlord pursuant to Section 10.10 of the Prime Lease, if any. Sublandlord makes no representations or warranties that such cabling exists or is functioning.

9. Alterations and Signage.

(a) Subtenant shall not make any alterations, additions, improvements, installations or modifications (collectively “Alterations”) in or to the Premises, without in each instance obtaining the prior written consent of Sublandlord and Prime Landlord, except in the case of Decorative Alterations; provided, however, that for purposes of this Sublease, Decorative Alterations shall not include interior wall adjustments. All requests for consent to Alterations shall be accompanied by “Plans” as defined in the Prime Lease. Any request for consent to Alterations and Plans, after such Alterations and Plans have been approved by Sublandlord, shall be promptly submitted to Prime Landlord by Sublandlord for review and approval under the terms of the Prime Lease unless the request is for Decorative Alterations in which case, upon request by Subtenant, Sublandlord shall provide the five (5) Business Days written notice required under the Prime Lease. After obtaining any approvals required hereunder, Subtenant shall make its Alterations subject to and in compliance with the terms and conditions of the Prime Lease (provided that Sublandlord will not be entitled to charge Subtenant any administrative fee as described in Section 5.6 of the Prime Lease, and only Prime Landlord will be entitled to charge such fee). Sublandlord shall be named an additional insured under the insurance required under Section 5.1(b) of the Prime Lease and Subtenant shall provide Sublandlord with the policies and certificates of insurance required under the Prime Lease prior to commencement of construction of any Alterations. All Alterations shall (unless otherwise agreed upon by Sublandlord and Subtenant) be made by Subtenant or Subtenant’s contractors (or, if required by the terms of the Prime Lease, by Prime Landlord or Prime Landlord’s contractors), at the sole cost and expense of Subtenant. If Sublandlord or its contractors (or Prime Landlord or Prime Landlord’s contractors) perform such work, Subtenant shall promptly pay to Sublandlord the total cost for design, engineering, management and construction of such Alterations. Upon completion of any Alterations, Subtenant shall deliver to Sublandlord as-built drawings (as described in Section 5.1(c) of the Prime Lease). The terms of this Section 9(a) shall also apply to the Subtenant’s Improvements.

-6-

(b) Subject to Prime Landlord’s prior written consent, Subtenant shall be permitted to install entry identification signage for the designation of Subtenant’s entity name at the entrance of the Premises and in the elevator lobbies of each floor comprising the Premises (which signage may include, with Prime Landlord’s consent, Subtenant’s logo and corporate graphics) and to have its entity name placed on the electronic directory board located in the lobby of the Building, at Subtenant’s sole cost and expense, and in compliance with applicable laws, codes, ordinances, rules and regulations. Sublandlord shall have the right to approve the entry identification signage, such approval not to be unreasonably withheld.

(c) Subtenant has informed Sublandlord that certain Alterations need to be made to the Premises in order to prepare the Premises for Subtenant’s occupancy (the “Subtenant’s Improvements”). The Subtenant’s Improvements shall be more particularly set forth on those Plans to be submitted by Subtenant to Sublandlord and Prime Landlord for approval. Subtenant will cause a licensed architect, selected by Subtenant and reasonably acceptable to Sublandlord (the “Architect”) and a licensed engineer, selected by Subtenant and reasonably acceptable to Sublandlord (the “Engineer”), to prepare the Plans. Prior to commencing the Subtenant’s Improvements (or any component thereof), Subtenant shall submit the Plans therefor to Sublandlord for Sublandlord’s approval. Sublandlord shall advise Subtenant within ten (10) Business Days after receipt of any Plans of its approval or disapproval thereof, and, if Sublandlord does not approve any of such Plans, of the reasons that the same are disapproved. If Sublandlord disapproves of any of the Plans, Subtenant shall deliver, or cause the Architect to deliver to Sublandlord, revised Plans, which respond to Sublandlord’s requests for changes. Sublandlord shall advise Subtenant within five (5) Business Days after receipt of any revised Plans of its approval or disapproval thereof, and, if Sublandlord does not approve any of the revised Plans, of the changes required in the same so that they will meet Sublandlord’s approval. This iterative process shall continue until Sublandlord and Subtenant mutually agree upon the Plans for the Subtenant’s Improvements (or the applicable component thereof, as the case may be). In either case, if Sublandlord fails to timely respond to Subtenant’s submission of initial Plans or revised Plans, Subtenant may deliver a second notice requesting Sublandlord’s approval of same; if Sublandlord fails to respond to such second (2nd) notice within five (5) Business Days after receipt of same, Sublandlord will be deemed to have approved the Plans; provided that Subtenant’s notice must state in bold face letters on the first page of such notice the following language: “IF SUBLANDLORD FAILS TO RESPOND TO THIS LETTER WITHIN FIVE (5) BUSINESS DAYS FROM SUBLANDLORD’S RECEIPT OF THIS LETTER, SUBTENANT’S REQUEST FOR SUBLANDLORD’S APPROVAL OF THOSE CERTAIN ALTERATIONS AND PLANS DESCRIBED IN THIS LETTER SHALL BE DEEMED TO BE APPROVED BY SUBLANDLORD.”. The Plans for the Subtenant’s Improvements (or any component thereof), as revised (if revised), after they have been approved or deemed approved by Sublandlord, shall be promptly submitted to Prime Landlord by Sublandlord for review and approval under the terms of the Prime Lease. The Plans as approved by Sublandlord and Prime Landlord are hereinafter referred to as the “Tenant’s Plans”. Subtenant shall perform the Subtenant’s Improvements in a good and workmanlike manner and in accordance with all Requirements, the terms of the Prime Lease and this Sublease and in conformance with the Tenant’s Plans. Subtenant agrees that, subject to delays caused by Sublandlord, Prime Landlord or Unavoidable Delays (as said term is defined in the Prime Lease) of which Subtenant has promptly notified Sublandlord, it will complete the Subtenant’s Improvements on or prior to the date that is twelve (12) months after the Commencement Date and Sublandlord shall not be obligated to disburse any of the Subtenant Allowance (as defined below) for Subtenant’s Improvements performed after such date (as said date may be postponed by delays described above of which Subtenant has promptly notified Sublandlord).

-7-

(d) Provided that no breach of this Sublease has occurred and is continuing, Sublandlord grants to Subtenant a cash allowance of up to One Million Fifty Two Thousand Two Hundred Eight Dollars ($1,052,208.00) (“Subtenant Allowance”) against the total construction cost of all of Subtenant’s Improvements (including design costs and the cost of all permits, licenses and fees related to the construction of the Subtenant’s Improvements), cabling and project management fees (collectively, “Costs”). Subtenant shall submit to Sublandlord, upon completion of Subtenant’s Improvements and Subtenant’s occupancy of the Premises, (i) a request for disbursement of the Subtenant Allowance, signed by an authorized officer of Subtenant, accompanied by a certificate of such authorized officer of Subtenant certifying that all amounts set forth in such request are validly due to contractors, Subtenant’s Architect, Engineer or other professionals, subcontractors and materialmen in connection with the furnishing of material for, or in the performance of, the Subtenant’s Improvements, (ii) invoices for the total amount of all Costs, (iii) a certificate from Subtenant’s Architect certifying that all Subtenant’s Improvements installations have been completed and that the Subtenant’s Improvements were performed in a good and workmanlike manner and in accordance with all Requirements and Tenant’s Plans, (iv) a waiver or release of mechanics liens by all contractors or subcontractors providing supplies to, or performing work for Subtenant in connection with Subtenant’s Improvements, and (v) a final certificate of occupancy. Sublandlord shall have thirty (30) days following such delivery of items (i)-(v) above, in which to verify all such invoices and inspect Subtenant’s Improvements to assure such work is in substantial compliance with the Tenant’s Plans previously approved by Sublandlord (which inspection shall be solely for the benefit of Sublandlord and no other person shall be entitled to rely thereon). Sublandlord shall pay to Subtenant a sum equal to the lesser of (i) the Subtenant Allowance or (ii) the Costs. Such payment shall be made no later than forty-five (45) days following the date on which Subtenant submits all of the items required under clauses (i)-(v) above. Any amount of Subtenant Allowance for which Subtenant has not requested disbursement as of the date that is ninety (90) days following Subtenant’s completion of the Subtenant’s Improvements shall be retained by Sublandlord. It is expressly understood and agreed that Subtenant shall complete, at its expense, the Subtenant’s Improvements whether or not the Subtenant Allowance is sufficient to fund such completion.

(e) Notwithstanding anything herein to the contrary, if Sublandlord determines, in its reasonable discretion, that the cost of removal and restoration under the terms of the Prime Lease of any Subtenant’s Improvements or Subtenant Alterations which constitute Specialty Alterations (as said term is defined in the Prime Lease) will exceed $50,000 in the aggregate, then Sublandlord may condition any approval under this Section 9 upon Subtenant’s increasing the Security Deposit by the amount of such cost.

10. Non-Disturbance Agreement. Sublandlord shall reasonably cooperate with Subtenant’s efforts to obtain a non-disturbance and attornment agreement however, failure of the Prime Landlord or its lender to provide an agreement satisfactory to Subtenant shall not be a condition of this Sublease and shall not affect the validity of this Sublease. Sublandlord shall not be required to make any payments or incur any liability or obligation in connection with obtaining such non-disturbance and attornment agreement(s).

-8-

11. Surrender. Subtenant shall, on the expiration or earlier termination of this Sublease, remove Subtenant’s Improvements, Subtenant’s Alterations and all of Subtenant’s trade fixtures, equipment and personal property (including any cabling and conduit installed by Subtenant under Section 10.10 of the Prime Lease, any security system installed by Subtenant under Section 10.12 of the Prime Lease, and any Telecommunications Equipment installed by Subtenant under Section 26.23 of the Prime Lease) as and to the extent required under the terms of the Prime Lease, repair any damage caused by such removal as and to the extent required under the terms of the Prime Lease, and surrender the Premises to Sublandlord in the condition required by the Prime Lease, including Sections 5.3 and 18.1 of the Prime Lease. Subtenant shall be responsible, at its expense, for (i) the removal of Subtenant’s Improvements and Subtenant’s Alterations, trade fixtures, equipment and personal property and any repair or restoration required under the Prime Lease in connection with such removal, and (ii) the repair of any damage caused by Subtenant, its contractors, employees, invitees or agents during the Term as required under the terms of the Prime Lease. If Subtenant fails or refuses to perform its obligations under this Section 11, the Prime Landlord or Sublandlord may, following notice to Subtenant, cause the same to be performed, in which event the Subtenant shall reimburse the party who caused Subtenant’s obligations to be performed the cost of such removal, restoration and repair, together with any and all damages which the Prime Landlord or Sublandlord may suffer as a result of Subtenant’s refusal or failure to perform its obligations under this Section 11. For avoidance of doubt, and notwithstanding any other provision of this Sublease to the contrary, Subtenant shall not be responsible for removal of any alterations or improvements performed by or on behalf of Sublandlord or any restoration required under the Prime Lease in connection with such removal unless Subtenant enters into a Direct Lease with the Prime Landlord. The obligations of Subtenant as provided in this Section 11 shall survive the expiration or termination of this Sublease.

12. Assignment and Subletting. Subtenant shall not assign, transfer, mortgage, pledge, or encumber this Sublease, nor sublet or rent the Premises or any part thereof, nor permit occupancy of the Premises or any part thereof by anyone other than Subtenant, without the prior written consent of Sublandlord and, to the extent required by the provisions of Article 13 of the Prime Lease, of Prime Landlord, nor shall any assignment or transfer of this Sublease be effectuated by the direct or indirect transfer of any interest by Subtenant or by the operation of law or otherwise without the prior written consent of Sublandlord and, to the extent required by the provisions of Article 13 of the Prime Lease, of Prime Landlord (any such assignment, transfer, mortgage, pledge, encumbrance, transfer of interests, sublease, rental or occupancy being referred to herein as a “Subtenant Transfer”). In the event of a Subtenant Default hereunder, Subtenant hereby assigns to Sublandlord the rent due from any subtenant of Subtenant and hereby authorizes each such subtenant to pay said rent directly to Sublandlord. Subtenant agrees to reimburse Sublandlord promptly for legal and other expenses incurred by Sublandlord (including those billed to Sublandlord by Prime Landlord and additional rent, if any, charged pursuant to Sections 13.4(a)(iv) and 13.7 of the Prime Lease) in connection with any requests by Subtenant for consent to any Subtenant Transfer. No Subtenant Transfer shall affect the continuing primary liability of Subtenant (which, following an assignment, shall be joint and several with the assignee). No consent to any Subtenant Transfer in a specific instance shall operate as a waiver in any subsequent instance. Any Subtenant Transfer in contravention of the provisions of this Section 12 shall be void and shall constitute a Default. Provided Prime Landlord consents or is deemed to consent to a Subtenant Transfer, (i) Sublandlord’s consent will not be unreasonably withheld and will be governed by the provisions of Section 13.4 of the

-9-

Prime Lease, except that the last sentence of 13.4(a) shall be replaced with the following: “If Sublandlord fails to respond to Subtenant’s request for approval of a Subtenant Transfer within twenty (20) days after Sublandlord’s receipt of such request, Subtenant may deliver a second notice requesting Sublandlord’s approval of same; if Sublandlord fails to respond to such second (2nd) notice within five (5) Business Days after receipt of same, Sublandlord will be deemed to have approved the proposed Subtenant Transfer provided that Subtenant’s second notice must state in bold face letters on the first page of such notice the following language: “IF SUBLANDLORD FAILS TO RESPOND TO THIS LETTER WITHIN FIVE (5) BUSINESS DAYS FROM SUBLANDLORD’S RECEIPT OF THIS LETTER, SUBTENANT’S REQUEST FOR SUBLANDLORD’S APPROVAL OF THE TRANSFER DESCRIBED IN THIS LETTER SHALL BE DEEMED TO BE APPROVED BY SUBLANDLORD.”; and (ii) Sublandlord shall have the rights under, and Subtenant shall be bound by, all of the terms of Sections 13.1(b), 13.1(c), 13.4(b), and 13.5-13.12, inclusive, with respect to such Subtenant Transfer. Notwithstanding anything to the contrary herein (but subject to the terms of the Prime Lease), the issuance of shares of Subtenant in an initial public offering on a nationally recognized security exchange will not constitute an assignment for the purpose of this Sublease.

13. Default. In the event of a Subtenant Default (including the breach of obligations under the Prime Lease incorporated herein by reference which breach is not cured within the applicable cure period following notice from Sublandlord), Sublandlord shall have all of the same rights and remedies as are available to Prime Landlord in the case of an Event of Default by Sublandlord under the Prime Lease (including the right to terminate this Sublease), including all other rights and remedies available at law or in equity. Unless otherwise provided in this Sublease, the applicable cure period for a breach of this Sublease shall be (i) for a monetary breach, the cure period set forth in Section 15.1(a) of the Prime Lease, and (ii) for a non-monetary breach, the cure period set forth in Section 15.1(b) of the Prime Lease; provided, however, that if Sublandlord has received a notice of such breach from Prime Landlord pursuant to the provisions of Article 15 of the Prime Lease, then Subtenant’s cure period shall be reduced to be (x) the cure period set forth in Section 15.1(b) of the Prime Lease, less ten (10) days with respect to the thirty (30) day cure period provided therein and less five (5) days with respect to the ten (10) day cure period provided therein and Sublandlord’s notice of Subtenant’s breach delivered pursuant to the provisions of this Section 13 shall specify the applicable cure period. There shall be no notice and cure period for breaches under Sections 15.1 (d) and (e) of the Prime Lease. The notice periods hereunder are in lieu of, and not in addition to, any notice periods provided by law or in the Prime Lease.

14. Security Deposit.

(a) Within sixty (60) days after execution of this Sublease, Subtenant shall submit to Sublandlord a deposit in cash equal to One Million Five Hundred Thousand Dollars ($1,500,000) (“Security Deposit”) which shall be held by Sublandlord without interest, as security for the faithful performance of all terms and conditions of this Sublease by the Subtenant. As long as these obligations are met for the full Term, such Security Deposit shall be returned within forty five (45) days after expiration or earlier termination of the Term. In the event of a Default by Subtenant, in addition to any other remedies Sublandlord may have, Sublandlord may use or apply the Security Deposit as necessary for the payment of any (a) Base Rent, Additional Rent or any other sum as to which Subtenant is in Default, or (b) any amount Sublandlord may spend or become obligated to spend, or for the compensation of any losses

-10-

incurred by Sublandlord in accordance with the terms of this Sublease by reason of Subtenant’s Default (including any damage or deficiency arising in connection with the reletting of the Premises). The foregoing shall not serve in any event to limit the rights, remedies or damages accruing to Sublandlord under this Sublease on account of a Default by Subtenant hereunder.

(b) Subtenant shall not pledge, mortgage, assign or transfer the Security Deposit or any interest therein.

(c) Subtenant shall have the right to deliver to Sublandlord an unconditional, irrevocable letter of credit in substitution for the cash Security Deposit required to be delivered by Subtenant pursuant to this Sublease, subject to the following terms and conditions. Such letter of credit shall be: (i) in form and substance satisfactory to Sublandlord in its reasonable discretion; (ii) at all times in the amount of the Security Deposit required to be delivered by Subtenant pursuant to this Sublease and shall permit multiple draws; (iii) issued by a commercial bank reasonably acceptable to Sublandlord from time to time and located in the San Francisco metropolitan area (or, alternatively, allowing draws via facsimile or overnight courier); (iv) written to specify that the payment of draws will be made only to a specified Sublandlord account (and have the payment instruction noted in the letter of credit); (v) made payable to, and expressly transferable and assignable at no charge by, Sublandlord (which transfer/assignment shall be conditioned only upon the execution of a written document in connection therewith and compliance with any applicable Federal anti-terrorist procedures); (vi) payable upon presentment to a local branch of the issuer of a simple sight draft or certificate stating only that Subtenant is in Default under this Sublease; (vii) of a term not less than one year; and (viii) at least thirty (30) days prior to the then-current expiration date of such letter of credit, either (1) renewed (or automatically and unconditionally extended) from time to time through the ninetieth (90th) day after the expiration of the Term, or (2) replaced with cash (or a new letter of credit satisfactory to Sublandlord and complying with the terms hereof) in the amount of the Security Deposit then required to be delivered by Subtenant pursuant to this Sublease. If Subtenant fails to timely comply with the requirements of item (viii) above, then Sublandlord shall have the right to immediately draw upon the letter of credit without notice to Subtenant and hold the proceeds as the Security Deposit hereunder. Each letter of credit shall be issued by a commercial bank that has a credit rating with respect to certificates of deposit, short term deposits or commercial paper of at least P-2 (or equivalent) by Moody’s Investor Service, Inc. or at least A-2 (or equivalent) by Standard & Poor’s Corporation, and shall be otherwise acceptable to Sublandlord in its reasonable discretion. If the issuer’s credit rating is reduced below P-2 (or equivalent) by Moody’s Investors Service, Inc. or below A-2 (or equivalent) by Standard & Poor’s Corporation, or if the financial condition of such issuer changes in any other materially adverse way as reasonably determined by Sublandlord, then Sublandlord shall have the right to require that Subtenant obtain from a different issuer a substitute letter of credit that complies in all respects with the requirements of this Section, and Subtenant’s failure to obtain such substitute letter of credit within ten (10) Business Days following Sublandlord’s written demand therefor shall entitle Sublandlord to immediately draw upon the then existing letter of credit in whole or in part, without notice to Subtenant and to hold the proceed thereof as the Security Deposit hereunder. In the event the issuer of any letter of credit held by Sublandlord is placed into receivership or conservatorship by the Federal Deposit Insurance Corporation, or any successor or similar entity, then, effective as of the date such receivership or conservatorship occurs, said letter of credit shall be deemed to not meet the requirements of this Section, and, within ten (10) Business Days thereof, Subtenant shall replace such letter of credit with other collateral

-11-

acceptable to Sublandlord in its sole discretion. If Subtenant fails to replace such letter of credit with other collateral acceptable to Sublandlord in its sole discretion within such ten (10) Business Day period, Sublandlord shall be entitled to immediately draw upon the then existing letter of credit in whole or in part without notice to Subtenant and to hold the proceeds thereof as the Security Deposit hereunder. Any failure or refusal of the issuer to honor a letter of credit presented by Sublandlord pursuant to the foregoing shall be at Subtenant’s sole risk and shall not relieve Subtenant of its obligations hereunder with respect to the Security Deposit required hereunder.

(d) On the first anniversary of the Rent Commencement Date, provided (i) no monetary Default occurred during the preceding year, and (ii) no breach by Subtenant under this Sublease shall then continue with respect to which Sublandlord has delivered notice to Subtenant, Subtenant shall have the right to reduce the Security Deposit (or, if applicable, the face amount of any letter of credit) to the amount of One Million Dollars ($1,000,000) by delivering notice of Subtenant’s request to Sublandlord. If the aforesaid conditions are met, Sublandlord shall deliver to Subtenant the amount of such reduction in the Security Deposit within ten (10) Business Days after Sublandlord’s receipt of Subtenant’s request or, if applicable, promptly execute and deliver an amendment to any then-existing letter of credit providing for the reduction in the face amount thereof. If the Security Deposit shall have been provided by Subtenant in letter of credit form, such reduction shall occur by means of Subtenant’s delivery to Sublandlord, concurrently with the delivery of Subtenant’s request to reduce the amount of the Security Deposit, of a substitute letter of credit in the reduced amount of the Security Deposit to be held by Sublandlord hereunder and in conformity with the requirements for a letter of credit which may be delivered by Subtenant to Sublandlord pursuant to this Sublease with respect to the Security Deposit; thereafter the letter of credit previously delivered by Subtenant to Sublandlord shall be returned to Subtenant.

(e) This Sublease will automatically terminate on the sixty first (61st) day after execution of this Sublease if Subtenant has not delivered the Security Deposit to Sublandlord at the time and in the manner described in this Section 14, unless Sublandlord elects to continue this Sublease by written notice to Subtenant.

15. Indemnification.

(a) Subtenant shall and hereby does indemnify, defend, protect and hold Sublandlord, its management company, if any, and their respective officers, directors, shareholders and employees (“Indemnified Parties”) harmless from and against any and all losses, liabilities, damages, claims, judgments, fines, suits, costs, interest, actions, demands, and expenses of any kind or nature (including, without limitation, reasonable attorneys’ fees) (collectively, “Claims”) asserted against, imposed upon or incurred by such Indemnified Parties by reason of (i) any violation caused, suffered or permitted by Subtenant, of any of the terms, covenants, agreements, or conditions of the Prime Lease or this Sublease, (ii) any act, omission or negligence of Subtenant, in the Premises or Building, including the introduction, use or release of any Hazardous Materials, or (iii) any accident, damage or injury to persons or property occurring upon or about the Premises or in connection with the use or occupancy of the Premises by Subtenant. In the event that the Prime Lease has indemnification provisions which require the Sublandlord to indemnify the Prime Landlord and said indemnification provision is invoked by the Prime Landlord, then Subtenant shall indemnify Sublandlord pursuant to the provisions of the Prime Lease if the claim for indemnification relates to the acts or omissions of Subtenant, the

-12-

condition of the Premises (if such condition is attributable to the acts or omissions of Subtenant) or any use of the Premises, common areas or other areas by Subtenant. For purposes of this Section 15, the term “Subtenant” shall include any parent, affiliates and subsidiaries or Subtenant and its or their agents, contractors, subcontractors, servants, employees, sub-subtenants or licensees. The obligations of Subtenant as provided in this Section 15 shall survive the expiration or termination of this Sublease.

(b) Sublandlord will indemnify, defend, protect and hold Subtenant harmless for and against any and all Claims arising out of (i) Sublandlord’s breach of the Prime Lease (unless attributable to Subtenant’s breach hereunder), (ii) any termination of the Prime Lease attributable to the acts or omissions of Sublandlord unless Subtenant has expressly consented to such termination or unless attributable to Subtenant’s breach hereunder, (iii) any acts or omissions in or about the Premises of, or work performed in or about the Premises by or on behalf of, Sublandlord or Sublandlord’s employees, agents, contractors or representatives, or (iv) Sublandlord’s breach of this Sublease.

16. Casualty, Condemnation, Failure of Services, Utilities or Access. If any part of the Premises is damaged, destroyed or condemned, or if any “Abatement Event” described in Section 26.22 of the Prime Lease occurs, then (x) if the Prime Lease is terminated with respect to the Premises pursuant to the provisions of the Prime Lease, this Sublease shall automatically terminate at the same time and Subtenant shall have no claim against Sublandlord or Prime Landlord for the loss of its subleasehold interest or any of Subtenant’s property; provided that so long as Subtenant is not in breach under the terms of this Sublease regarding which Sublandlord has given Subtenant notice, Sublandlord will not exercise any right to terminate the Prime Lease set forth in Articles 11 or 12 of the Prime Lease without the express written consent of Subtenant, which consent shall be given or denied within ten (10) Business Days after Sublandlord’s request and Subtenant’s failure to respond in such timeframe shall be deemed consent to such termination; and (y) so long as Subtenant is not in breach under the terms of this Sublease, if Subtenant desires to have Sublandlord exercise its termination rights under the provisions of Articles 11 and 12 of the Prime Lease, then Subtenant shall give Sublandlord notice of same at least ten (10) Business Days prior to the date on which Sublandlord must exercise such termination rights under the terms of the Prime Lease and Sublandlord may thereafter either terminate the Prime Lease and this Sublease or terminate only this Sublease, and Subtenant shall have no claim against Sublandlord or Prime Landlord for the loss of its subleasehold interest or any of Subtenant’s property, and (z) if the Prime Lease is not terminated, then, except as provided under (y), this Sublease shall not be terminated but shall also continue in full force and effect, except that, to the extent permitted under the Prime Lease, if Sublandlord obtains from Prime Landlord any abatement of rent under the Prime Lease in connection with the relevant casualty, condemnation or Abatement Event and related to the Premises or a portion thereof, then Subtenant shall have the benefit of such abatement of Rent related to the Premises or portion thereof as reasonably determined by Sublandlord.

17. Insurance. Subtenant shall promptly and fully comply with all of the insurance requirements imposed upon Sublandlord under Article 11 and Section 5.1(b)(iii) of the Prime Lease, including, without limitation, obtaining property insurance covering the Tenant Improvements installed by Sublandlord, the Subtenant’s Improvements, and Tenant’s Property, and all other insurance coverages required thereunder. Subtenant shall provide Sublandlord with the policies, including evidence of the required waivers of subrogation, and certificates of insurance required under the Prime Lease, and Subtenant shall add Sublandlord, as well as the Insured Parties (as defined in the Prime Lease), as additional insureds/loss payees.

-13-

18. Holdover. In the event that Subtenant holds possession of the Premises or any part thereof after the expiration of the Term or sooner termination of this Sublease, by lapse of time or otherwise, Subtenant shall pay Sublandlord, for each month (or portion thereof) Subtenant remains in possession of the Premises or any part thereof, one hundred fifty percent (150%) of the amount of the Fixed Rent due under the Prime Lease for the last month prior to the date of such termination or expiration, plus one hundred percent (100%) of any applicable Additional Rent due under the Prime Lease (using the base year of calendar year 2010). Subtenant shall also pay all damages sustained by Sublandlord from any loss or liability resulting from such holding over and delay in surrender, including any liabilities of Sublandlord under Section 18.2 of the Prime Lease. No holding-over by Subtenant, nor the payment to Sublandlord of the amounts specified above, shall operate to extend the Term. Nothing herein contained shall be deemed to permit Subtenant to retain possession of the Premises after the expiration of the Term or sooner termination of this Sublease, and no acceptance by Sublandlord of payments from Subtenant after the expiration of the Term or sooner termination of this Sublease shall be deemed to be other than on account of the amount to be paid by Subtenant in accordance with the provisions of this Section. The provisions of this Section shall not be deemed to waive any of Sublandlord’s rights or in any way affect Sublandlord’s other remedies contained herein or otherwise available.

19. Financial Statements. Subtenant shall, within ten (10) Business Days following Sublandlord’s request (which shall be made no more often than once in any 12 month period), deliver to Sublandlord Subtenant’s audited financial statements for the most recently completed fiscal year or if audited statements for Subtenant are not prepared, then unaudited financial statements for the most recent fiscal year of Subtenant (Sublandlord expressly acknowledges that Subtenant’s unaudited financial statements are typically not completed until June 30th of the calendar year immediately following the fiscal year for which such statements are prepared and that audited financial statements are finalized thereafter) which shall be certified to be true and correct (subject to standard accounting adjustments and such good faith additional caveats as Subtenant may specify concurrently with Subtenant’s delivery of such statements to Sublandlord) by Subtenant’s Chief Financial Officer. Any failure by Subtenant to deliver financial statements as and when required above which Subtenant fails to cure within ten (10) days after notice of such breach, shall constitute a Default under this Sublease, entitling Sublandlord to exercise any and all remedies available to Sublandlord under this Sublease

20. Brokers. Subtenant hereby represents and warrants to Sublandlord that it has not dealt with any broker or finder in connection with this Sublease, except Jones Lang LaSalle, whose commission shall be paid by Sublandlord pursuant to a separate written agreement. Subtenant shall and hereby does indemnify and hold Sublandlord harmless from and against any and all Claims asserted against, imposed upon or incurred by Sublandlord by reason of breach of this representation and warranty. Sublandlord hereby represents and warrants to Subtenant that it has not dealt with any broker or finder in connection with this Sublease, except CBRE, Inc., whose commission shall be paid by Sublandlord pursuant to a separate written agreement. Sublandlord shall and hereby does indemnify and hold Subtenant harmless from and against any and all Claims asserted against, imposed upon or incurred by Subtenant by reason of breach of this representation and warranty.

-14-

21. Parking. Parking rights are not included in this Sublease.

22. Estoppel Certificates. Either party hereto (the requested party) agrees that from time to time upon not less than fifteen (15) days prior notice by the other party (requesting party), the requested party or its duly authorized representative having knowledge of the following facts will deliver to the requesting party, or to such person or persons as the requesting party may designate, a statement in writing certifying (i) that this Sublease is unmodified and in full force and effect (or if there have been modifications, that the Sublease as modified is in full force and effect); (ii) the date upon which Subtenant began paying Rent and the date(s) to which the Rent has been paid; (iii) that to the best of the requested party’s knowledge, the requesting party is not in default under any provision of this Sublease or if in default, the nature thereof in detail; and (iv) that there has been no prepayment of Rent except as provided for in this Sublease. The requirements of this Section 22 are in addition to and not in place of any similar obligations in the Prime Lease.

23. Confidentiality. Each party covenants, represents and warrants that it shall keep the terms of this Sublease confidential and will not disclose any such terms or distribute copies of this Sublease to any person or entity without obtaining the prior written consent of the other party. Subtenant covenants, represents and warrants that it shall keep the terms of the Prime Lease confidential and will not disclose any such terms or distribute copies of the Prime Lease to any person or entity without obtaining the prior written consent of Sublandlord. However, each party hereto will have the right to deliver a copy of this Sublease and/or the Prime Lease (i) to its accountants, lenders, counsel, real estate brokers and any prospective subtenant or assignee on a need to know basis provided the recipient agrees to keep such information confidential as provided above, (ii) as may be required by judicial process, (iii) as may be required by the Securities Exchange Commission, the rules of any stock exchange on which the shares of the disclosing party may be traded, or by applicable law or (iv) to its parent, affiliate or subsidiaries on a need to know basis provided the recipient agrees to keep such information confidential as provided above.

24. Waiver of Right of Redemption. Subtenant hereby waives, for Subtenant and for all those claiming under Subtenant, any and all rights now or hereafter existing to redeem by order or judgment of any court or by any legal process or writ, Subtenant’s right of occupancy of the Premises after any termination of this Sublease as a result of Subtenant’s Default.

25. Authority If Subtenant is a corporation, trust or partnership, each individual executing this Sublease on behalf of Subtenant hereby represents and warrants that Subtenant is a duly formed and existing entity qualified to do business in the State of California and that Subtenant has full right and authority to execute and deliver this Sublease and that each person signing on behalf of Subtenant is authorized to do so. If Sublandlord is a corporation, trust or partnership, each individual executing this Sublease on behalf of Sublandlord hereby represents and warrants that Sublandlord is a duly formed and existing entity qualified to do business in the State of California and that Sublandlord has full right and authority to execute and deliver this Sublease and that each person signing on behalf of Sublandlord is authorized to do so, subject to obtaining Prime Landlord’s consent as provided below.

-15-

26. Incorporation of Prime Lease.

(a) This Sublease is in all respects, and shall remain, subject and subordinate to all of the terms and conditions contained in the Prime Lease, and all of the terms and conditions of the Prime Lease, where not expressly inconsistent with the terms hereof and except as otherwise stated herein to the contrary, are hereby incorporated into this Sublease and shall be binding upon Sublandlord and Subtenant with respect to the Premises to the same extent as if Subtenant were named as tenant and Sublandlord as landlord under the Prime Lease. For purposes of this Sublease, references in the Prime Lease to the term of lease shall mean the Term of this Sublease and references to the premises, demised premises, or similar references in the Prime Lease shall mean the Premises. Effective as of the Commencement Date, Subtenant hereby assumes all of the obligations of Sublandlord, as the tenant, under the Prime Lease other than the obligation to pay rent as set forth in the Prime Lease. Sublandlord shall have all of the rights of the Prime Landlord under the Prime Lease as against Subtenant; however, Sublandlord will not have the (i) the rights of Prime Landlord set forth in Section 6.3 of the Prime Lease (said right to be solely the right of Prime Landlord), (ii) the right to terminate described in Section 11.4 of the Prime Lease (said right to be solely the right of Prime Landlord), (iii) the access rights described in Sections 14.1(a) of the Prime Lease (said right to be solely the right of Prime Landlord; additionally, the right set forth in Section 14.1(b) to enter the Premises to “perform Work of Improvement to the Premises or the Building” shall be the sole right of Prime Landlord and not Sublandlord), and (iv) the protections provided by Section 26.3 of the Prime Lease. Notwithstanding anything in this Sublease to the contrary, Sublandlord shall have the right (but no obligation) to enter the Premises to inspect and exercise its cure rights under the Prime Lease (including under Sections 6.4 and 15.8 of the Prime Lease). Additionally, the parties agree that any Restoration Notice will be issued by Prime Landlord only. Subtenant expressly acknowledges and agrees to Prime Landlord’s rights reserved under the Prime Lease. Subtenant further agrees that Prime Landlord’s exercise of its rights under the Prime Lease shall not constitute an actual or constructive eviction or relieve Subtenant from any of its obligations under this Sublease, or impose any liability upon Sublandlord or its agents.

(b) Provided Subtenant is not then in Default hereunder, Sublandlord agrees not to exercise (i) its option to renew the term of the Prime Lease set forth in Section 2.6 of the Prime Lease or (ii) the termination right set forth in Section 2.7 of the Prime Lease. Provided Subtenant timely pays the Rent due under this Sublease, Sublandlord will pay the rent due under the Prime Lease before an Event of Default shall occur under the Prime Lease for failure to make such payment, and payment of the rent due under the Prime Lease as aforesaid shall be Sublandlord’s sole obligation under the Prime Lease provided, however, that the foregoing is not intended to make the Subtenant responsible for removal of any alterations or improvements performed by or on behalf of Sublandlord or any restoration required under the Prime Lease in connection with such removal unless Subtenant enters into a Direct Lease with the Prime Landlord. Provided Subtenant is not then in Default hereunder, Sublandlord will not amend or modify the Prime Lease except to reduce the amount of basic rent due thereunder.

(c) Sublandlord shall have no obligation to pass through to Subtenant the benefit of any basic rent reductions that may result from an amendment or modification of the Prime Lease below the amount of the basic rent in effect as of the Commencement Date hereof.

-16-

(d) If a term or provision of this Sublease is inconsistent or in conflict with a term or provision of the Prime Lease, the term or provision of this Sublease shall control as between Sublandlord and Subtenant.

(e) Sublandlord shall have no liability whatsoever to Subtenant if the Prime Landlord fails to perform any of its obligations under the Prime Lease or fails to properly perform or provide any services, maintenance, repairs, restoration, insurance, or other matters, obligations or actions to be performed or provided by the Prime Landlord under the terms of the Prime Lease. Provided, however, at Subtenant’s expense and request, Sublandlord will take all reasonable actions necessary to attempt to enforce the Sublandlord’s rights as tenant under the Prime Lease for the benefit of Subtenant with respect to the Premises.

(f) Subtenant covenants and agrees that Subtenant will not do anything which would constitute a default under the Prime Lease or omit to do anything which Subtenant is obligated to do under the terms of this Sublease and which would constitute a default under the Prime Lease.

(g) Any expansion, renewal, first refusal, first offer, cure, termination or other similar rights or options in the Prime Lease are reserved solely to Sublandlord (without any obligation to exercise any such rights or options) and may not be exercised by Subtenant. Any right in the Prime Lease for Sublandlord to contest property taxes with the authority imposing the taxes is reserved solely to Sublandlord without any obligation to exercise such right. Any rights to determine the name of the Building, prohibit or allow competitors signage, or similar rights are reserved to Sublandlord.

(h) If the consent or approval of Prime Landlord is required under the Prime Lease with respect to any matter, Subtenant shall be required first to obtain the consent or approval of Sublandlord with respect thereto and, if Sublandlord grants such consent or approval, Sublandlord will promptly forward a request for consent or approval to the Prime Landlord and, at Subtenant’s cost and expense, will use reasonable efforts to obtain such consent. Sublandlord shall have no liability to Subtenant for the failure of Prime Landlord to give its consent.

(i) Sublandlord represents that, to the knowledge of Sublandlord’s Director of Corporate Real Estate without review of files, as of the Effective Date the Prime Lease is in full force and effect and there exists under the Prime Lease no material default or Event of Default by either Prime Landlord or Sublandlord.

(j) Notwithstanding anything herein to the contrary, the following Sections of the Prime Lease are not incorporated herein: 11.1(g) and 11.1 (h).

27. Contingency: This Sublease is contingent on Prime Landlord’s written consent pursuant to Article 13 of the Prime Lease. Sublandlord will use reasonable efforts to promptly obtain such consent, and failure to obtain such consent within forty-five (45) calendar days following Subtenant’s execution hereof shall, at the written election of either party delivered to the other party within ten (10) Business Days after the expiration of such forty-five (45) calendar day period, operate to terminate this Sublease and release Sublandlord and Subtenant from all obligations hereunder.

-17-

28. Notices. Any notice required or permitted to be given hereunder shall be in writing and may be given by certified mail, return receipt requested, personal delivery, Fed Ex or other similar overnight delivery service making receipted deliveries. If notice is given by certified mail, return receipt requested, notice shall be deemed given two (2) Business Days after the notice is deposited with the U.S. mail, postage prepaid, addressed to Subtenant or Sublandlord at the address set forth below. If notice is given by personal delivery, Fed Ex or other similar overnight delivery service, notice shall be deemed given on the date the notice is actually received in the case of personal delivery (provided that any notice delivered on a weekend or holiday will be deemed given on the next-succeeding Business Day) or one (1) Business Day after the notice is sent by Fed Ex or another similar overnight delivery service. Either party may by notice to the other specify a different address for notice purposes.

If to Sublandlord:

Visa U.S.A. Inc.

P.O. Box 8999

San Francisco, California 94128-8999

Attn: Office of the General Counsel

With copies to:

CBRE, Inc.

5100 Poplar Avenue, Suite 1000

Memphis, Tennessee 38137

Attn: Portfolio Administration Services – VISA

and

VISA U.S.A. Inc.

P.O. Box 636001

Highlands Ranch, CO 80163-6001

Attn: Director US Real Estate & Facility Operations

If to Subtenant:

Prior to Subtenant’s Move-In to the Premises:

45 Fremont Street, 32nd Floor

San Francisco, CA 94105

Attn: Legal Department

Following Subtenant’s Move-in to the Premises:

At the Premises

Attn: Legal Department

-18-

With a copy to:

Jonathan M. Kennedy

Shartsis Friese LLP

One Maritime Plaza, 18th Floor

San Francisco, California 94111

29. Miscellaneous Provisions.

(a) Subtenant shall comply, and shall cause its agents, contractors, subcontractors, servants, employees, sub-subtenants, licensees or invitees to comply, with all applicable Requirements, all Rules and Regulations, Prime Landlord’s reasonable access control procedures set forth in the Prime Lease and the Rules and Regulations concerning Subtenant’s access to the Premises set forth in the Prime Lease.

(b) This Sublease is in all respects, and shall remain, subject and subordinate to any mortgage, deed of trust, ground lease or other instrument now or hereafter encumbering the Building or the land on which it is located, and to the terms and conditions of the Prime Lease and to the matters to which the Prime Lease, including any amendments thereto, is or shall be subordinate. In confirmation of the subordination provided for in this paragraph, Subtenant shall, at Sublandlord’s request, promptly execute any requested certificate or other document.

(c) This Sublease shall be construed under and in accordance with the laws of the State of California. IN ANY ACTION OR PROCEEDING ARISING HEREFROM, SUBLANDLORD AND SUBTENANT HEREBY CONSENT TO (I) THE JURISDICTION OF ANY COMPETENT COURT WITHIN THE STATE OF CALIFORNIA, (II) SERVICE OF PROCESS BY ANY MEANS AUTHORIZED BY CALIFORNIA LAW, AND (III) IN THE INTEREST OF SAVING TIME AND EXPENSE, TRIAL WITHOUT A JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY EITHER OF THE PARTIES HERETO AGAINST THE OTHER OR THEIR SUCCESSORS IN RESPECT OF ANY MATTER ARISING OUT OF OR IN CONNECTION WITH THIS SUBLEASE, THE RELATIONSHIP OF SUBLANDLORD AND SUBTENANT, SUBTENANT’S USE OR OCCUPANCY OF THE PREMISES, AND/OR ANY CLAIM FOR INJURY OR DAMAGE, OR ANY EMERGENCY OR STATUTORY REMEDY.

(d) This Sublease shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, executors, administrators, legal representatives, successors and permitted assigns.

(e) The failure of a party hereto to insist in any instance upon the strict keeping, observance or performance of any covenant, agreement, term, provision or condition of this Sublease or to exercise any election herein contained shall not be construed as a waiver or relinquishment for the future of such covenant, agreement, term, provision, condition or election, but the same shall continue and remain in full force and effect. No waiver or modification of any covenant, agreement, term, provision or condition of this Sublease shall be deemed to have been made unless expressed in writing and signed by the waiving party. No surrender of possession of the Premises or of any part thereof or of any remainder of the term of this Sublease shall release Subtenant from any of its obligations hereunder unless accepted by Sublandlord in writing.

-19-

(f) In the event that any one or more of the provisions contained in this Sublease shall for any reason be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provision hereof.

(g) This Sublease with all Exhibits hereto constitutes the sole agreement of the parties and supersedes any prior understanding or written or oral agreements between the parties respecting this Sublease.

(h) In the event that either Sublandlord or Subtenant should bring suit for the possession of the Premises, for the recovery of any sum due under this Sublease, or because of the breach of any provision of this Sublease or for any other relief against the other, then all costs and expenses, including reasonable attorneys’ fees, incurred by the prevailing party therein shall be paid by the other party, which obligation on the part of the other party shall be deemed to have accrued on the date of the commencement of such action and shall be enforceable whether or not the action is prosecuted to judgment.

(i) This Sublease may be executed in separate counterparts, each of which, when so executed and delivered, shall be an original, but all such counterparts shall together constitute one and the same instrument. Each counterpart may consist of a number of copies hereof, each signed by less than all, but together signed by all, of the parties hereto. Copies of documents or signature pages bearing original signatures, and executed documents or signature pages delivered by a party by facsimile or e-mail transmission of an Adobe® file format document (also known as a .pdf file) shall, in each such instance, be deemed to be, and shall constitute and be treated as, an original signed document or counterpart, as applicable. Any party delivering an executed counterpart of this Sublease by facsimile or e-mail transmission of an Adobe® file format document also shall deliver an original executed counterpart of this Sublease, but the failure to deliver an original executed counterpart shall not affect the validity, enforceability, and binding effect of this Sublease.

(j) All Exhibits attached to this Sublease are a part of this Sublease for all purposes and are incorporated herein by this reference.

(k) Neither this Sublease, nor any memorandum, affidavit or other writing with respect thereto, shall be recorded by Subtenant or by anyone acting through, under or on behalf of Subtenant.

(l) If Sublandlord assigns its leasehold estate in the Prime Lease Premises Sublandlord shall have no obligation to Subtenant arising after that assignment provided that Sublandlord shall remain liable to Subtenant with respect to any claims or other matters under this Sublease arising prior to such assignment and provided that Sublandlord’s assignee expressly assumes for the benefit of Subtenant, the obligations of Sublandlord hereunder. Subtenant shall then recognize Sublandlord’s assignee as Sublandlord of this Sublease.

(m) Each party agrees that it will not raise or assert as a defense to any obligation under this Sublease or make any claim that this Sublease is invalid or unenforceable due to (i) any failure of this document to comply with ministerial requirements, including but not

-20-

limited to requirements for corporate seals, attestations, witnesses, notarization, or other similar requirements, or (ii) the execution of this Sublease by electronic or stamped signatures, and each party hereby waives the right to assert any such defense or make any claim of invalidity or unenforceability due to any of the foregoing.

(n) Sublandlord’s obligations under this Sublease to use reasonable efforts shall not require Sublandlord to file or pursue any legal action, arbitration or mediation.

(o) Submission of this instrument for examination or signature by Subtenant does not constitute a reservation of, option for or option to lease, and it is not effective as a lease, sublease or otherwise until execution and delivery by both Sublandlord and Subtenant.

(p) Subtenant hereby waives any and all rights under and benefits of Subsection 1 of Section 1931, 1932, Subdivision 2, 1933, Subdivision 4,1941, 1942 and 1950.7 (providing that a landlord may only claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by a tenant or to clean the premises) of the California Civil Code, Section 1265.130 of the California Code of Civil Procedure (allowing either party to petition a court to terminate a lease in the event of a partial taking), and any similar law, statute or ordinance now or hereinafter in effect.

SUBLANDLORD and SUBTENANT have executed this Sublease as of the Effective Date.

| SUBLANDLORD: | ||

| VISA U.S.A. INC. | ||

| By: | /s/ Byron Pollitt | |

| Name: | Byron Pollitt | |

| Title: | CFO | |

| SUBTENANT: | ||

| SUNRUN INC. | ||

| By: | /s/ Barak Ben-Gal | |

| Name: | Barak Ben-Gal | |

| Title: | CFO | |

-21-

EXECUTION COPY

EXHIBIT A

COPY OF PRIME LEASE

LEASE

595 MARKET STREET, INC.

a Delaware corporation,

Landlord

and

VISA U.S.A. INC.,

a Delaware corporation,

Tenant

for

595 Market Street

San Francisco, California

November 17, 2008

TABLE OF CONTENTS

| Page | ||||

| ARTICLE 1 BASIC LEASE PROVISIONS |

1 | |||

| ARTICLE 2 PREMISES; FIRST OFFER SPACE; TERM; RENT |

4 | |||

| ARTICLE 3 USE AND OCCUPANCY |

13 | |||

| ARTICLE 4 CONDITION OF THE PREMISES |

13 | |||

| ARTICLE 5 ALTERATIONS |

13 | |||

| ARTICLE 6 REPAIRS |

16 | |||

| ARTICLE 7 INCREASES IN TAXES AND OPERATING EXPENSES |

18 | |||

| ARTICLE 8 REQUIREMENTS OF LAW |

23 | |||

| ARTICLE 9 SUBORDINATION |

25 | |||

| ARTICLE 10 SERVICES |

27 | |||

| ARTICLE 11 INSURANCE; PROPERTY LOSS OR DAMAGE |

33 | |||

| ARTICLE 12 EMINENT DOMAIN |

38 | |||

| ARTICLE 13 ASSIGNMENT AND SUBLETTING |

40 | |||

| ARTICLE 14 ACCESS TO PREMISES |

47 | |||

| ARTICLE 15 DEFAULT |

48 | |||

| ARTICLE 16 LANDLORD’S RIGHT TO CURE; FEES AND EXPENSES |

51 | |||

| ARTICLE 17 NO REPRESENTATIONS BY LANDLORD; LANDLORD’S APPROVAL |

52 | |||

| ARTICLE 18 END OF TERM |

53 | |||

| ARTICLE 19 QUIET ENJOYMENT |

54 | |||

| ARTICLE 20 NO SURRENDER; NO WAIVER |

54 | |||

| ARTICLE 21 WAIVER OF TRIAL BY JURY; COUNTERCLAIM |

54 | |||

| ARTICLE 22 NOTICES |

55 | |||

| ARTICLE 23 RULES AND REGULATIONS |

55 | |||

| ARTICLE 24 BROKER |

56 | |||

| ARTICLE 25 INDEMNITY |

56 | |||

| ARTICLE 26 MISCELLANEOUS |

57 | |||

| ARTICLE 27 PARKING |

63 | |||

Schedule of Exhibits

| Exhibit A | Floor Plan of Premises | |

| Exhibit A-1 | Floor Plan of First Offer Space | |

| Exhibit B | Definitions | |

| Exhibit C | Work Letter | |

(i)

| Exhibit D | Design Standards | |

| Exhibit E | Cleaning Specifications | |

| Exhibit F | Rules and Regulations | |

| Exhibit G | List of Direct Competitors | |

| Exhibit H | Form of Subordination, Non-Disturbance and Attornment Agreement | |

(ii)

LEASE

THIS LEASE is made as of the 17th day of November, 2008 (“Effective Date”), between 595 MARKET STREET, INC., a Delaware corporation (“Landlord”), and VISA U.S.A. INC., a Delaware corporation (“Tenant”).

Landlord and Tenant hereby agree as follows:

ARTICLE 1

BASIC LEASE PROVISIONS

| PREMISES | The entire twenty-eighth (28th), twenty-ninth (29th) and thirtieth (30th) floors of the Building, as more particularly shown on Exhibit A. | |

| BUILDING | The building, fixtures, equipment and other improvements and appurtenances now located or hereafter erected, located or placed upon the land known as 595 Market Street, San Francisco, California. | |

| REAL PROPERTY | The Building, together with the plot of land upon which it stands. | |

| COMMENCEMENT DATE | September 1, 2009 | |

| RENT COMMENCEMENT DATE | June 1, 2010. | |

| EXPIRATION DATE | August 31, 2019, or the last day of any renewal or extended term, if the Term of this Lease is extended in accordance with any express provision hereof. | |

| TERM | The period commencing on the Commencement Date and ending on the Expiration Date. | |

| PERMITTED USES | Executive and general offices, and any other ancillary use consistent with the operation of a first-class office building. | |

| BASE YEAR | Calendar year 2010. | |

| TENANT’S PROPORTIONATE SHARE | 10.489% | |

| AGREED AREA OF BUILDING | 417,979 rentable square feet, as mutually agreed by Landlord and Tenant. The rentable square footage of the Building has been calculated in accordance with BOMA ANSI Z65.1-1996. | |

| AGREED AREA OF PREMISES |